NEVER MIX MONEY WITH RELATIONSHIPS

Lord Rama sought Sugreeva's help in finding Sita, leading to the

demise of Bali, and making Sugreeva the king. However, Sugreeva became engrossed in

palace life, forgetting his promise. Laxman's strong wake-up call mirrors the

irony of lending money to friends or relatives. It may reach a point where you must

remind them, jeopardizing the relationship. The unspoken rule emerges never mix

money with relationships. The delicate balance between financial matters and

personal connections highlights the importance of clear boundaries to avoid

straining bonds over hard-earned money.

DIVERSIFICATION:

Successful Investing requires a diverse investment portfolio to boost financial power. Exactly like how Lord Ram had strategic alliance and help from Sugriva, Hanuman, and Vibhishan.

Investments in multiple assets help your portfolio to become strong with the ability to withstand any shocks like Lord Ram forming a team with diverse strengths.

NEED FOR PROTECTION:

Remember the scene in Ramayana where Laxman was on the brink of

life, and Hanuman fetched a magical herb? In real life, there's no Hanuman or

magic herbs—just reality. A sudden illness or twist of fate can leave your

family grappling with grief and financial stress. That's where life and health

insurance come in, not as heroes but as practical guardians. Picture life

insurance as a safety net, promising that if you're not there, your loved ones

won't fall. It shields against unexpected storms—ensuring bills are paid,

education is secured, and dreams don't crumble. Health insurance is your

warrior against illness, battling medical bills. Don't wait for a magical

rescue; secure your life and health today. It's an act of love, promising your

loved one’s protection and support in the face of the unknown.

BUDGET IS A MUST:

Draw a Line in the Sand: Your Lakshman Rekha

for Finances

Remember the Lakshman Rekha in

Ramayana, the sacred boundary that protected Sita? In your financial life, you

too can create a similar Lakshman Rekha – a budget. Just as Lakshman guarded

against threats, your budget safeguards you from overspending and financial

chaos.'

The key is to distinguish

between needs, like rent and groceries, and wants, like that fancy gadget or

impulsive shopping spree. Treat your budget like

Lakshman, firmly discerning the

essential from the tempting. Prioritize needs, allocate wisely, and any remaining can be for

occasional indulgences, just like Lakshman allowed

for Hanuman's occasional playful banter.

Remember, your financial well-being is

in your hands. Take control, create your Lakshman Rekha, and step into a future of

prosperity and peace of mind.

NO SHORT CUTS:

During Lord Ram's 14-year 'Vanvas,' he faced several hardships,

including the kidnapping of Devi Sita. Instead of taking shortcuts, he waited

for the right moment with steadfast patience.

Similarly, in the domain of investments, it's

equally important to endure market volatility and remain committed for the long

term.

Lord Ram's vanvas episode shows us the power

of patience and persistence for success.

.

Shortcuts might seem tempting, but remember, true success, like rescuing Sita,

takes time and dedication. So, stay calm, stay invested, and watch your

financial forest blossom with the fruits of your patience.

Beware the Mantharas in Disguise:

Kaikeyi heeded Manthara's bad advice, leading

to disaster in the entire Ayodhya.

In finances, avoid a 'Manthara.' Picking trustworthy advisors is vital, akin to

reliable companions on your financial journey.

Don't let social fin experts who are not answerable to you and don’t even know

your financial situation steer you astray;

Opt for advisors aligned with your goals, who understand your financial

requirements, and asset allocation thus ensuring a stable path to financial

well-being.

Be careful of anyone who

promises speedy returns or offers "too good to be true" deals. Perhaps all they want is your money,

not your well-being. Remember, if it sounds too good to be true, it probably is!

Choosing the right financial

advisor can be the difference between a happy ending and a Ramayana-style

tragedy for your finances. Do your research, avoid Mantharas in disguise, and

find an AMG (Advisor/Mentor/Guide) who

genuinely cares about your financial health, and guides you to the path of

Financial Freedom.

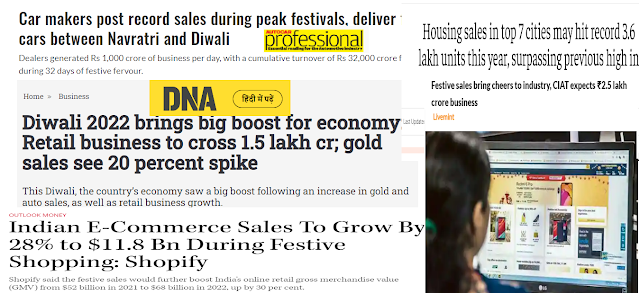

Start Small, Grow Steadily

A financial corpus takes time and careful

preparation to develop. To accomplish their aim of vanquishing Ravan, Bhagwan

Ram and Laxman painstakingly built a network and Vanar Sena over the years,

starting from nothing.

just as Rama didn't rush into battle with

Ravana, don't get tempted by quick fixes or risky shortcuts. Building a strong

corpus takes time and discipline.

Building a corpus takes time and dedication. Don't get discouraged by

short-term setbacks. Remember, Ram faced many obstacles before reaching

Ayodhya. By consistently investing, diversifying your portfolio, and seeking

expert guidance, you'll gradually build a strong financial fortress, ready to

face any Ravana-type devil in the form of inflation and taxes.

FOCUS ON SOLUTIONS, AVOID THE BLAME GAME:

Despite his greatest attempts, Lakshmana

failed to prevent Sita Mata's kidnapping. Lord Ram

refrained from blaming Lakshman; Rama

immediately shifted his focus to finding solutions. He gathered allies,

strategized, and ultimately rescued Sita.

Likewise, in the realm of finances, mistakes

are inevitable. Whether investing in the wrong fund, facing unforeseen losses,

or overlooking opportunities, errors happen. Yet, akin to Rama's approach, the

crucial step is to release regrets and embrace solutions.

Learn from mistakes, focus on solutions

change your strategy if required, and take decisive action turning mistakes into

stepping stones to Financial Freedom.

CONCENTRATE ON THE LARGER PICTURE. YOUR ULTIMATE GOAL:

Following Sita's abduction. However, Lord Ram

did not crumble. He overcame every adversity with unrelenting determination,

his sights fixated on the goal: Sita's rescue.

Similar sensitivity is regularly seen in the

stock market's ups and downs. Rather than giving in to a passing panic, find

motivation in Rama's dedication.

Maintaining focus on your long-term financial objectives and being undeterred by

market swings is the true mantra for success in equity markets.

Concentrate on the Bigger Goal of Financial Freedom and don’t get swayed.

SIPs are Your Bridge to Success

Each stone, carefully laid

by monkeys and Vanaras, created a bridge between Rameshwaram and Lanka bringing

Prabhu Ram closer to his goal of defeating Ravana.

Similarly, your financial goals can be reached through a similar

bridge: the bridge of SIPs.

The monthly disciplined small investments in Equity Mutual Funds called SIPs are like the Vanaras (monkey

army) building the bridge to your Financial Freedom.

With each SIP, you lay another stone on your

path to financial freedom. Start small, be consistent, and trust the power of

compounding. Remember, the earlier you start, the more time your money must

grow. Don't wait for the perfect moment, start building your Financial Freedom

bridge today!

AVOID GREED... THE

GOLDEN DEER:

Sita being lured away by the golden deer perfectly captures the danger of

chasing unrealistic investment promises. The Golden deer shimmering beauty masked its true purpose: to distract and deceive. Similarly, the lure of "too-good-to-be-true" investment returns, often promising the moon, can be equally dangerous.

- High-promised

returns often come with high risks, like volatile investments or even

scams. Don't fall prey to the glitter, prioritize stability and long-term

growth.

- Just like Lakshmana

tried to caution Sita, financial advisors, and experts often warn against

chasing unrealistic returns. Heed their advice and stick to your Lakshmana

Rekha of sensible investing.

- Educate yourself about different investment options and

risks. The more informed you are, the better equipped you are to make wise

decisions and avoid falling prey to financial traps.

- Even better, get an

AMG to handhold you.

AMG = Advisor/Mentor/Guide

Forget Sanjeevani,

Grab the Hill:

Hanuman lifted the entire mountain, Dronagiri, as he couldn’t pinpoint and find the life-saving Sanjeevani herb

While finding a single "multi-bagger" stock (a stock that increases

in value many times over) can be like searching for needles in a haystack,

there's a simpler, Hanuman-approved approach: EQUITY MUTUAL FUNDS

Equity Mutual funds hold a basked of 100s of top class companies.

So no need to go in search of that elusive Gem of a stock.

Equity MutualFunds automatically spread your investment across various

companies, reducing risk and protecting you from volatility. It's like carrying

the whole hill, ensuring you don't miss out on any hidden Sanjeevanis...

Seek guidance from qualified financial advisors who can help you choose the

right index funds based on your risk tolerance and goals.

RELEASE EGO

The mighty Ravana, his ten heads brimming with pride, refused to acknowledge his faltering grip on Sita, and this

arrogance led to his downfall.

Allowing ego to dictate your decisions,

particularly when it comes to holding onto losing investments, can have dire

consequences for your financial well-being.

Understand that reducing losses is a calculated decision rather

than a show of weakness. As with loss-booking, it's important to evaluate and

adjust, getting rid of underperforming assets to make room for other, more

successful financial choices. Ravan's story is a sobering lesson to put reason

above emotion, particularly in the ever-changing world of investing.

In Conclusion:

These timeless financial lessons from the Ramayana will help you

create a solid financial foundation and set yourself up for success as you work

toward your financial objectives. Recall that the road to prosperity is paved

with perseverance, self-control, prudent decision-making, and a small dose of

heavenly inspiration from the epic itself.

Regards

Srikanth Matrubai

All the best,

Regards,

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/