FINANCIAL

FREEDOM IS NOT JUST FOR THE RICH

Follow these steps for you to achieve the same.

Financial freedom is often perceived as a privilege reserved for the wealthy. However, as an experienced financial advisor, I firmly believe that financial independence is attainable for everyone, regardless of their current financial circumstances.

Just like a seasoned traveler relies on a map and

navigational tools, you can follow the steps given in this article to achieve

your financial freedom.

Reflecting on those experiences, it is clear that financial

freedom, a state of being financially self-sufficient and stress-free, is a

goal you must choose.

Achieving this freedom is not an overnight process; it

requires a systematic and disciplined approach. It is important to avoid making

uninformed decisions that can hinder progress.

EMERGENCY FUND IS THE PILLAR OF A STRONG FINANCIAL

PLAN

We live in an era where joint family is an endangered species and thus you

are left to fend for yourself even in an emergency financial situation.

In a Contingency Situation, the options for you could vary from selling

your prized processions to selling your blue chip shares/Mutual funds to taking

a Credit Card loan or even borrowing from your friend or the next-door

moneylender.

All these could lead to potentially rock your Financial Plan. This is where

an EMERGENCY FUND comes into the picture. One of the biggest lessons that

COVID has given all of us is the importance of having an EMERGENCY FUND

Emergency Fund acts as a Shock Absorber of a Financial Plan. The absence of

it can make a Financial Plan turbulent. Once you have this covered…. then the

mental peace you have is unparalleled.

If you don’t have an Emergency Fund, SET IT UP NOW!!!

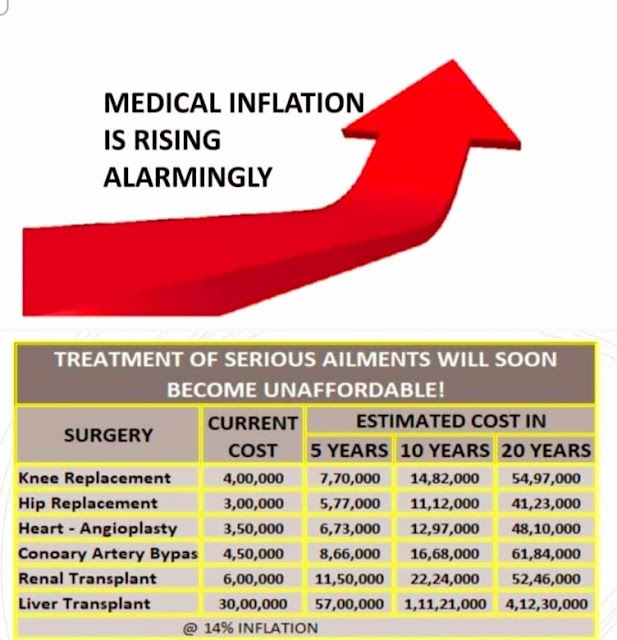

GET INSURANCE:

The most vital aspect of Financial Planning is Risk

Management. We never know when life will throw a Googly at us (covid, etc). Thus,

it’s absolutely crucial that we are adequately covered for such emergencies by

way of Health Insurance, Vehicle Insurance, Property Insurance, accident

insurance, etc.

Insurance can be expensive, but it can save you a lot of

money in the long run. If you are unable to work due to an illness or injury,

health insurance can help pay for your medical expenses. If you are in an

accident, auto insurance can help pay for the cost of repairs or replacement.

And if your home or belongings are damaged in a disaster, Property insurance

can help pay for the cost of repairs or replacement.

Insurance is thus, not an expense, but a smart way to

ensure your financial stability and peace of mind.

CREATE A BUDGET

Create a plan for your money to flow properly. It’s a

blueprint that guides your financial decisions.

This plan called a Budget in other words, helps you

effectively manage your income and expenses.

List out all your income from various sources like Salary,

investments, rent, government benefits, etc.

Likewise list out all your expenses like Food,

Transportation, Rent, Utility bills, insurance, and EMIs.

Be sure to include

even your irregular and make provision for unexpected expenses as this will

make your budget plan realistic.

Once you know where exactly your money is going and coming

from, you can then decide how much you can save and invest.

Note that the budget plan should be flexible. Our life is

constantly changing. Income may vary, expenses may vary and thus your budget plan

should be flexible enough to have all these adjustments to navigate our

financial journey.

The plan for the money flow will help establish a strong

financial foundation so that you can easily achieve your financial goals.

SAVING AND INVESTING:

Saving and investing are the pillars of building a solid

financial foundation. Saving helps you build up a cushion of money in case of

unexpected expenses like a job loss or a medical emergency, while investing

helps you create wealth over time and achieve all your financial goals like

Buying a home, etc

Set aside a portion of your income and build an emergency

fund to deal with unexpected expenses. Find investment opportunities that suit

your goals.

Don’t

just save… INVEST!

SAVING IS

MONEY KEPT ASIDE FOR AN FORESEEABLE EXPENSE (NEED)

INVESTING IS MONEY KEPT ASIDE

FOR A FUTURE EXPENSE (WANT/COMFORT)

SAVING is a process of

accumulating money. With Saving, you are safeguarding your money and is

risk-free.

INVESTING is the process of

CREATING WEALTH and could involve some form of Risk.

SAVINGS doesn't need much

expertise.

INVESTING is complex and

expert hand-holding is a MUST at least in the initial stages and in some

products, inevitable.

If you are not sure

how to save or invest, consider talking to a financial advisor. A financial

advisor can help you create a financial plan that meets your specific needs.

GOAL

It’s proven that we humans work better and are more

successful when we have a specific goal to focus on, as a goal will give us

direction and keep us motivated.

Divide your financial goals into specific short terms like

Visiting Char Dham, medium-term goals like buying a Car, and long-term goals like

Child Marriage or Buying a Dream House.

By writing these goals, you will get a purpose and

motivation to make your money directed towards achieving those goals.

Having clear financial goals will propel you faster toward

the goal of Financial Freedom.

AVOID DEBT LIKE A PLAGUE:

Debt will take you down the hold and digging will only get

deeper and deeper with every passing day of your debt life.

If you already do have a debt, work vigorously towards

reducing and clearing off the same. Please note that having debt will also

affect your cibil score and thus you will have to pay higher interest if

you need further debt. Be mindful of

your spending habits and resist the temptation to rely on credit cards or loans

for unnecessary purchases. Focus on living within your means and utilizing cash

or debit for your day-to-day expenses.

Imagine that you're

trying to run a race, but you're carrying a heavy backpack. The backpack is

full of debt, and it's slowing you down. No matter how hard you try, you can't

seem to catch up to the other runners.

That's what debt can do to you. It can weigh you down and make it

difficult to achieve your financial goals.

One of the easiest ways to avoid getting into a debt trap

is by

a) Having an Emergency Fund

b) Having a pre-planned expenses list and sticking to it

c) Pay all your bills ON TIME

Remember, avoiding debt is an essential component of

achieving financial freedom. By adopting a prudent approach to spending,

building an emergency fund, and repaying existing debts strategically, you can

pave the way for a more secure and prosperous financial future. Stay committed

to your goals, practice financial discipline, and celebrate the milestones as

you move closer to a debt-free life.

DIVERSIFY YOUR INCOME SOURCES:

A strong sturdy building stands for 100s of years only due

to its PILLARS.

A farmer relying only on 1 crop is vulnerable to

unpredictable crop failures but if he has multiple fields and multiple crops,

the chance of a bountiful harvest is sure to happen.

Likewise, try to have multiple income sources so that you

have a safety net that gives you a cushion against unexpected financial setbacks

in any one of the income sources.

Do explore and pursue various income avenues, leveraging

the power of diversification to secure your financial future.

By spearing your investments across various asset classes

and sectors, you reduce the risk associated with a single investment.

Having multiple sources of income (however small) gives you a sense of security, and more freedom and reduces your risk thus increasing your

chances of achieving Financial Freedom sooner.

REACHING GOAL QUICKER BY TOPPING UP

To reach your destination efficiently, you need to fuel

your journey with consistent efforts. Just as a car requires fuel, your

financial journey demands regular savings and investments.

Just as a smart shopper seizes discounts during a sale,

adding funds to your investments during market downturns can enable you to buy

assets at lower prices, potentially increasing your returns when the market

rebounds.

REVIEW & RE-ROUTE IF NECESSARY

On a long journey, it's natural to encounter detours and

obstacles. The same applies to your financial journey. Unexpected expenses,

market fluctuations, and life events can throw you off course. That's why it's

crucial to review and adjust your financial plan regularly, like recalibrating

your GPS.

Even the best of plans can go awry due to unforeseen and

unavoidable changes in life and circumstances

A review and a route change are a must in such a case.

Say a change of job, childbirth, a death in the family, tax

law change, or even a change of place of work could lead significant impact on

the financial priorities.

Just as a ship adjusts its course to reach its destination,

we may need to keep making necessary adjustments in our financial plan to stay

on track to achieving Financial Freedom

A review will help in accessing your progress and identify

areas where improvements are needed.

Remember, with each adjustment you make, you are optimizing

your plan and inching closer to achieving your dreams. The review helps in making

informed and proactive steps to reach our goal of Financial Freedom more quicker.

An experienced Financial Advisor by your side can provide valuable guidance and

give insights into investment opportunities and make sure your strategy aligns

with your goals helping you reach your goal on time with the least stress.

Achieving Financial Freedom is not a pipedream.

It is a realistic and achievable goal

that anyone can pursue with the right habits and strategies. By following the

steps outlined in this article, you can set yourself on the path to financial

freedom and enjoy life to the fullest.

.

Conclusion:

Financial freedom is not an exclusive privilege of the wealthy; it is a goal

that can be pursued by anyone committed to taking the necessary steps.

Remember, it starts with cultivating healthy financial habits, building a

strong foundation, embracing incremental progress, leveraging the power of

compounding, seeking knowledge, and surrounding yourself with a supportive

network. Embrace the journey towards financial freedom, knowing that you have

the potential to unlock a future of independence and security, regardless of

your current financial circumstances.

All The Very Best,

Srikanth Matrubai

Author – Don’t Retire Rich

This article of mine is also published in MEDIUM

https://medium.com/@matrubai.srikanth/financial-freedom-is-not-just-for-the-rich-a-guide-d1f2c7f04d29

All the best,

Regards,

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/