Greetings,

Now that the Union

Budget 2023 presentation is over…. the various images and posts that get shared

on WhatsApp University should be confusing you a lot. Isn't it

I thought why not add my own views, version, and opinion and make you more

confused!!

Ha ha… oops… give

you MORE CLARITY and help you plan better.

Disclaimer: I am not a Certified Tax Planner and you are

better off consulting your CA before filing your Taxes

So…. Lets deep dive

THE MAIN

HIGHLIGHTS WHICH AFFECT YOU AND ME

1. Minimum Tax

Exemption raised to Rs.7 lakhs in the New Tax Regime

2. The Senior

Citizen Savings Scheme limit is doubled from 15 lakhs to 30 lakhs

3. Post office MIS

scheme increased to 9 lakhs per individual from the Existing 4.5 lakhs and for

JOINT from 9 lakhs to 15 lakhs

4. For women folk,

a NEW Small Savings Scheme has been introduced. Rs.2 lakh max can be invested

earning an interest of 7.5% per annum.

5. Surcharge at

the highest rate is reduced from 37% to 25%

6. Overseas

remittance above 7 lakhs TCS (Tax Collected at Source) increased from 5% to 20%

7. Income read

from Insurance Policies (Traditional policies) where the premium paid is above

5 lakhs WILL NO LONGER BE EXEMPT FROM TAXES

Income from traditional insurance policies where the premium is over Rs 5 lakh will no more be exempt from taxes.

WHO GAINS FROM THIS BUDGET?

Senior Citizens gain hugely

from this budget

With the Senior

Citizen Savings Scheme limit doubled from 15 lakhs to 30 lakhs, they

have a much bigger basket to route their money into a Guaranteed Safe scheme.

In fact,

Married Senior

Citizen Couples can now together invest up to:

- Rs 60 lakh in

Senior Citizen Savings Scheme (SCSS)

- Rs 15 lakh in

Post Office – Monthly Income Scheme (PO-MIS)

- Rs 30 lakh in

PMVVY (7.4% interest and runs for a period of 10 years)

SCSS is truly

attractive with an 8% interest rate and that too payable quarterly. SCSS is for a

period of 5 years and can be extended by 3 years.

PO-MIS pays 7.1%

interest and must be considered only after options are exhausted.

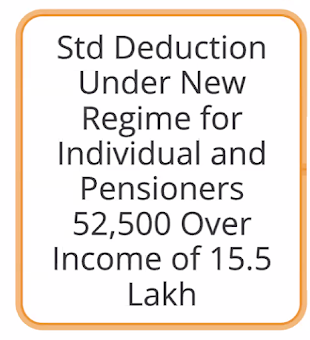

The Senior

Citizen's Pensioners have been given the benefit of Standard Deduction even in

the New Tax Regime

Family

Pension: A deduction of 33.33% or Rs. 15000, whichever is less, is allowed from

the family pension in the new tax regime from 1st April 2023.

All

these schemes, put together, will earn a senior citizen couple a monthly income

of around Rs 70,500, on an investment of Rs 1.1 crore. These

are assured returns.

And if you do have money after investing in all the above-mentioned Government schemes, make sure to look at the RBI Floating Savings Bond, which offers you 35% more interest than the NSC (National Savings Certificate. These Bonds have a tenure of 7 years.

REQUEST TO SENIOR CITIZENS:

We also request

that Senior Citizens too to think beyond their daily expenses and have a plan for

their financial goals too.

Yes... the risk of living longer is the one most seniors miss.

Also, if seniors are planning to leave a legacy for their children and

grandchildren, it makes sense that they look beyond the schemes by Government

and consider Mutual funds in consultation with their Financial Experts.

Equities are

a must for all ages, especially considering that Equities are the BEST asset

class with great earning potential and easy liquidity.

2. ULTRA HNIs

Yes...The rich will get richer!!

Due to the surcharge reduction from 37% to 25, the net effective tax rate comes down from

42.74% to 39% thus for someone earning about 5 CRORES the saving will be as high as 20 lakhs per annum!

3. WOMEN FOLK

With a new instrument named MAHILA SAMMAN SAVING CERTIFICATE introduced, women

can now deposit Rs.2 lakhs at a fixed rate of 7.5% interest for a period of 2

years.

Definitely better than an FD and moreover it's guaranteed by the Government!

Sukanya Samruddhi Scheme continues but it's locked and one

can invest only up to 15 years of a girl child’s age. This MSSC can be a good

alternative as a partial withdrawal option is there

LOSERS

1.

Individual earning less than 8 lakhs and

using a host of deductions u/s 80c, 80D, and having a Home Loan loses a lot as he

has nothing offered either in terms of rebates or exemption.

2.

Going on a Foreign Tour? Be ready to shell

out more. Yes.. earlier you were paying 5% TCS (Tax Collected at Source) and

now this has been increased to 20%. BTW, you can claim the TCS credit while

filing your Tax return but yes your money GOES out of your bank and you need to wait

till you pay taxes

VERY IMPORTANT:

Up to 7 lakhs exemption in NEW TAX REGIME does not mean you pay only 10% after

7 lakhs… no…

For

income upto Rs.6,99,000 it NIL

But

once you touch Rs.7,00,000 it's calculated as follows

0

to 3 lakhs = NIL

3

lakhs to 6 lakhs =5% which means 5% * 3 lakhs = Rs.15,000

6

lakhs to 7 lakhs = 10% which means 10% * 1 lakh = Rs.10,000

Thus

Rs.15,000 + Rs.10,000 so you are paying Rs.25,000 on an income of Rs.7 lakhs

NEW TAX REGIME OR

OLD TAX REGIME?:

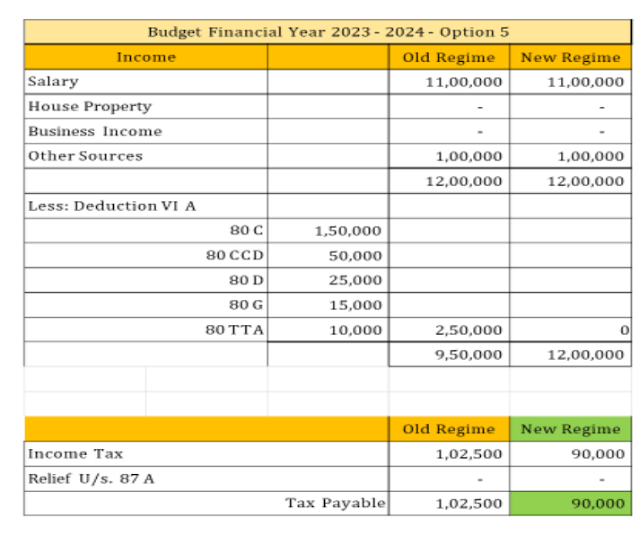

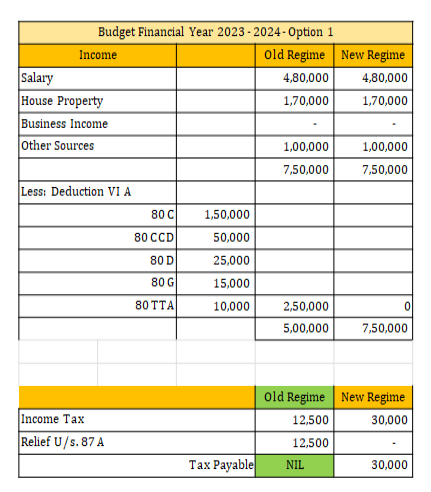

On the face of it, the NEW TAX REGIME looks beneficial but deeper analysis tells a different story, especially for those earning less than Rs.10 lakhs per annum

In fact, when we dig deeper, Rs.15.5 lakhs is the BREAK-EVEN

The NEW Tax Regime is easy to calculate due to no

deductions and exemptions to be calculated and thus gives the feeling of having

MORE in hand

but due to this FEELING OF HAVING MORE, the tendency to

SPEND will definitely rise and thus a Financial Expert is a MUST.

An AMG (Advisor/Mentor/Guide) will ensure that you also THINK AND PLAN for your future financial obligations be it your Children's Education, your Own Retirement

Under the Old Tax Regime, you were sort of FORCED to save

by investing in schemes/plans of 80C and thus at least some part of your future

financial obligations were taken care of by default but the New Tax Regime sort

of makes you feel like a FREE BIRD and thus your Future Financial Security

depends now on your BEHAVIOUR!!

Overall, in terms of personal finance the announcements in the Union Budget

2023-24 brought some tax relief for the common man, especially those looking to

opt for the new tax regime.

Please

note that the tax is zero if your taxable income is, for example, Rs. 6

lakhs. However, you still need to file income tax returns and validate

the 87A rebate.

THERE ARE STILL A LARGE NUMBER OF DEDUCTIONS AND EXEMPTIONS AVAILABLE IN THE OLD REGIME AND ITS

BETTER THAT YOU KEEP A NOTE OF IT

WE ENCOURAGE YOU

TO CUT AND KEEP THE FOLLOWING FOR YOUR FUTURE REFERENCE

Deductions available in the Old Tax Regime

Apart from the standard deduction of Rs 50,000 which is

now available to both tax regimes, there are several deductions available in

the old tax regime, which taxpayers cannot avail of in the new tax regime. Some of the common deductions claimed by taxpayers in the old tax regime are:-

- Section 80C (PPF, ELSS, Life insurance, etc):

Rs 1.5 lakhs

Section 80 CCD (1B) (National Pension Scheme): Rs 50,000

- Section 80D (Mediclaim): Rs 25,000 (for self)

+ Rs 50,000 (for senior citizen parents)= Rs 75,000

- HRA (House rent allowance): Lesser of (a)

Actual rent paid or (b) 50% of basic salary + DA (for metro cities) or 40%

of basic salary + DA (for metro cities)

- LTA (Leave travel allowance): This will depend on

the maximum LTA provided by your employer and your actual cost of travel

by air (economy class only), train (up to First AC fare), or bus.

- Section 24 (home loan interest): Rs 2 lakhs

Taxpayers should know that these deductions are available only in the old tax regime. However, whether you can claim these deductions or not, and also how many deductions you can claim, depends on your personal financial situation.

Before thinking of switching to a NEW TAX regime

note that the new tax regime will not give you the benefit of deductions under Section 80c, 80D

and also not benefit of Housing Loan Interest besides the

HRA benefit

Old Tax Regime still looks attractive to the majority of people especially if your earning is less than 10 lakhs

In a nutshell,

the Old Tax Regime encourages you to SAVE!

the New Tax Regime encourages you to SPEND!

Of course... do consult your CA for the final assessment

#DontRetireRich #WealthOfWisdom

I have shared some Options both with and without deductions

Go through the same and you will get a clear idea of what to choose

All the very best

Srikanth Matrubai

All the best,

Regards,

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/