10 secrets of How to Become a Crorepati from Scratch

What does it take to

become a Crorepati from scratch? Is it luck, talent, or hard work?

The truth is, it is a

combination of all three, plus some other factors that you may not be aware of.

In this article, we will

uncover 10 secrets that can help you overcome the challenges and obstacles that

stand between you and your financial goals. Whether you want to start a

business, invest in the stock market, or create a passive income stream, these

secrets will guide you on your journey to becoming a Crorepati from scratch.

1. UNDERSTAND GOOD DEBT V/S BAD DEBT:

Crorepatis are very savvy

when it comes to Debt. They are okay with Good Debt but avoid Bad Debt

Good Debt are those debts

wherein you are taking a loan to purchase assets that will generate INCOME for

you.

(Bank Overdraft, Student

Loans, Home Loan) Good Debts help you create more income and build Wealth and assets.

Even a Housing Loan is a

good debt as it will help you buy a Home which is an asset that appreciates in

value over time and of course also gives you shelter, comfort, and tax

benefits.

Bad Debts like Credit

cards carry very high-interest rates and fees. Credit Cards can also damage

your CIBIL score hurting your ability to get loans at lower rates.

Car Loan is also an

example of Bad debt as they tend to have high interest rates and also Car is a

depreciating asset.

Personal Loan is the

WORST Debt to have as they not only have very high interest rates but also have

no collateral. Personal Loans are easy to get and hence many fall into the trap

of getting easy money and end up getting caught in the cycle of debt leading to

financial distress.

If you dear readers, are

already in any of these Bad Debts, get out of them as early as possible.

1. Only borrow money when

you absolutely need to.

2. Make more than the

minimum payment on your debts.

3. Pay off high-interest

debt first.

Debt, when used properly,

can be a great tool to achieve your financial goals.

2. LIVE WITHIN YOUR MEANS:

Crorepatis tell your

money WHERE to go rather than wondering WHERE DID MY MONEY GO?

Budgeting helps you in

this. If you don’t know where the paisa goes, soon you’ll lose the rupees… then

the house.

Remember that there is a

huge gap between WANTING TO SAVE & ACTUAL SAVING and this gap can be easily

filled by BUDGETING.

The BEST budget according

to Financial Planners is

50% Needs

30% Wants

20% Savings

Each month that you

manage to spend less than your budget allows, you’re effectively contributing

to the reservoir of your lifelong wealth.

This will lead to more

savings at the end of each month in turn will help you avoid getting into debt

too!

3. INVEST DON'T JUST SAVE:

Once Crorepati people

have created a budget and saved some money, they go ahead and do something more

important than just saving money. They Invest!

Invest the difference between your income and expenses.

Invest your savings

according to your asset allocation, risk horizon, and investment time frame.

Work with a financial

advisor to create an investment plan that is right for you.

Automate your savings and

investments so that you can save and invest more money without even having to

think about it.

Investing rather than

just saving, is a smart way to grow your wealth and achieve your financial

goals. Saving alone is not enough, as inflation can erode the purchasing power

of your money over time. Investing helps you beat inflation and earn compound interest,

which means earning interest on your interest.

For example, if you

invest Rs.10,000 in an asset that pays 10% annual interest, after one year you

will have Rs.11,000. If you reinvest the interest, after another year you will

have Rs.12,100. That’s Rs.100 more than if you had just saved the money without

investing.

The difference becomes

even bigger over time, as you can see in this table:

Year

Amount (Rs.)

Interest Earned(Rs.)

1

10,000

1,000

2

11,000

1,100

3

12,100

1,210

4

13,310

1,331

5

14,641

1,464

This is the power of

compound interest, and it can help you grow your money faster than saving

alone.

4. DIVERSIFY AND HAVE MORE INCOME STREAMS:

Depending month after

month on your salary can be frustrating and Crorepatis make sure they have

multiple streams of income. With rising living standards, peer pressure, and

social pressure, it’s become a necessity to start earning more and more.

Do understand that the

more different ways you make money, the more financially secure you will be.

Crorepatis learn and

implement ways to earn money outside of their regular jobs. Utilise fully your

time and resources like maybe renting your car or taking tuition during

weekends, tailoring, writing, getting rent, interest on deposits, dividends

from investments, etc. to ramp your income streams.

Having multiple income

streams not only bolsters financial stability but also accelerates wealth

accumulation. It offers a safety net during economic downturns and allows

individuals to take advantage of various opportunities for growth and financial

independence.

That’s what Crorepati

does and that’s what you have to do to hasten your journey of scaling up to

become a Millionaire.

5. JUDICIOUSLY USE THE SALARY RAISE AND BONUS:

Getting swayed by the ads

of the latest iPhone, Tanishq, and Amazon is understandable, but they

make your salary rise and bonus disappear as fast as it appears.

Using this EXTRA money

towards

a) Settling Pending Bills

and clearing Debt (especially high-interest debt like Credit Card bills) is the

best way to speed up your journey to becoming a Millionaire.

b) If you do not have an

emergency fund or have a smallish amount, scaling up the all-important

Emergency Fund will help your Finances get a Shock Absorber

c) Buy that long pending

BIG EXPENSE like the Jewellery for your wife, the long pending car for the

family.

Instead of going for the oh-so-easy-to-get EMI, use this Bonus Money and

Salary rise to fund that BIG expense. This helps in avoiding debt and the peace

of mind of getting a good asset to the family.

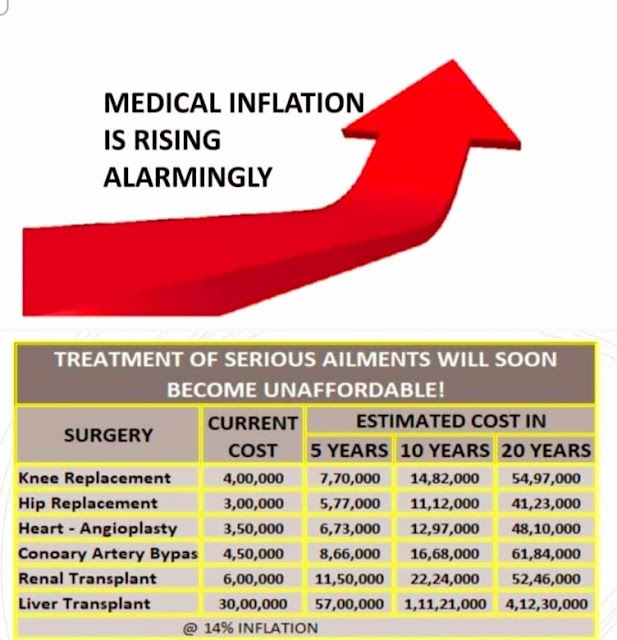

d) Top-up Insurance

Cover.

Whenever anyone takes insurance in the beginning the cover is small. As

you start growing in wealth and also as the responsibilities increase, the

insurance coverage should also compulsorily go up, and using the Salary Rise and

Bonus is the way Crorepati do and so should you.

Remember, Salary Rise and

Bonus is NOT FREE MONEY. It's given to us as you have worked hard and you

deserve it. Use it judiciously and hasten your journey towards becoming a

Millionaire.

"Supercharge your wealth creation with Top-up SIP. Elevate your monthly investments by 10% each year to outpace inflation.

Just as plants need a FERTILIZER boost for healthy growth, a SIP top-up accelerates your financial journey.

For example, consider a SIP with an initial investment of Rs. 10,000 per month for 20 years, assuming a 12% annual return. This would result in a corpus of Rs. 1.14 crores. However, by adding a monthly top-up of Rs. 2000, your corpus after 20 years would grow to Rs. 1.56 crores. That's an extra Rs. 42 lakhs!

#DontRetireRich #WealthOfWisdom"

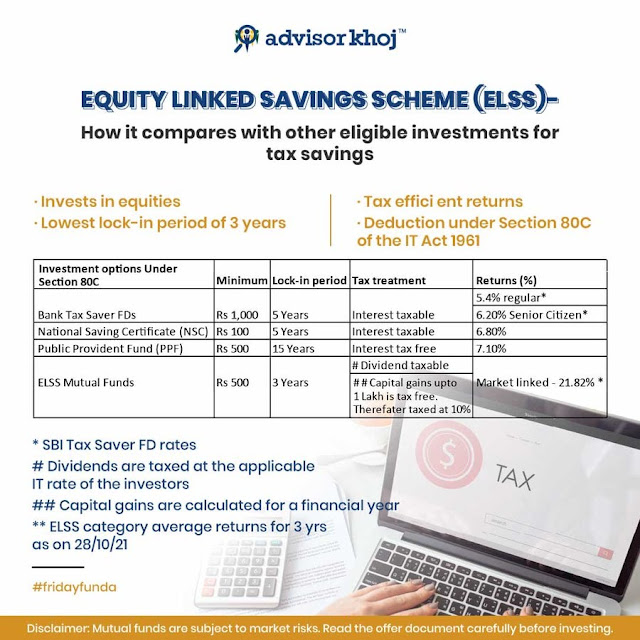

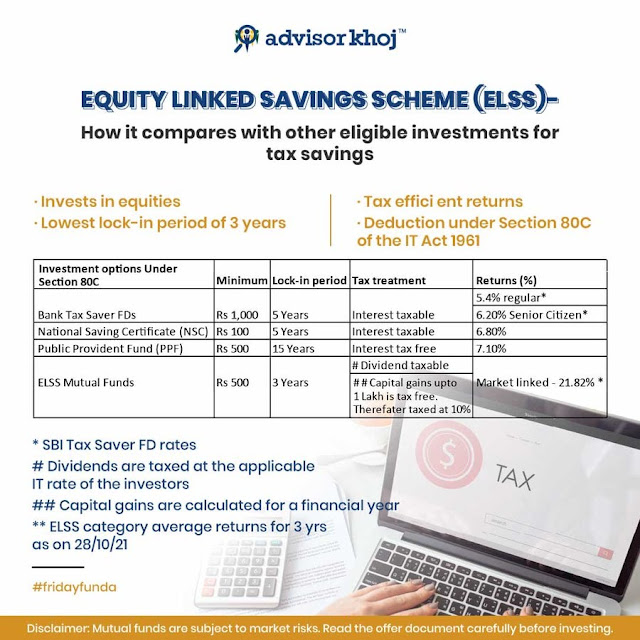

6. USE TAX LAWS TO MAXIMUM BENEFITS

Crorepati are adept at

leveraging tax laws to their advantage, and adopting similar strategies can

certainly expedite your path toward Crorepati status.

Take advantage of all the

deductions and credits that you are eligible for.

Some investments are more

tax-efficient than others. For example, an investment in EQUITY LINKED SAVINGS

SCHEME is much better than an Endowment or money-back for tax-saving purposes.

Efficient usage of tax

benefits helps even in Asset Protection (insurance) and Asset Gathering (Equity

Investments)

Always consult a

qualified tax professional before making any tax-related decisions.

7. FOLLOW ASSET ALLOCATION RELIGIOUSLY

Asset allocation is the

process of dividing your investment portfolio among different asset classes,

such as stocks, bonds, and cash. If you have observed closely, Crorepati follow

Asset Allocation and use it strategically to increase their Wealth.

Using Equities for

Growth, Bonds/Dividends/Rent for regular income, and Liquid funds for Emergency

helps the Crorepati not only take advantage of volatility in different assets

but also helps reduce risks.

Do note that asset Allocation depends on each individual and varies

depending on your goals, risk profile, and time horizon.

Asset Allocation is also

a very dynamic process and needs constant monitoring and hence a Mentor would

be highly recommended.

Following the Asset

Allocation strategy prudently not only helps you book profit at higher levels

but also enter assets at lower levels.

Asset Allocation has the potential to deliver Above-Average Returns with

below-average volatility!

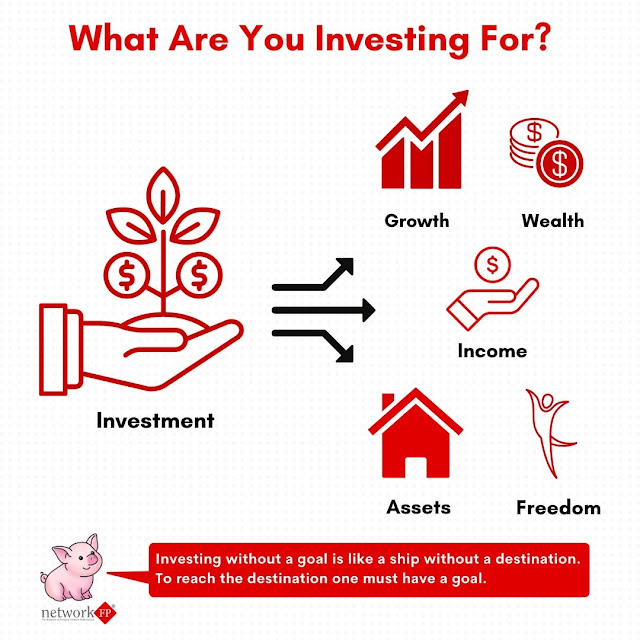

8. UNDERSTAND THE POWER OF GOALS

Identifying a Goal helps

in adapting the asset class that matches the comfort level and time horizon of

the goal.

Crorepati has measurable

goals which help in better planning and sharper focus.

Clear-cut goals also help in tracking the progress of the goal and doing course corrections if needed.

Do remember PERSONAL

FINANCE IS PERSONAL FOR A REASON.

Everyone has different needs and goals requiring a distinct

portfolio.

Focus on YOUR goals and needs so that a financial plan is tailored to

your unique situation.

By setting clear

measurable goals, you can increase your chances of achieving financial success.

Crorepati know this and put it to work in their own lives.

9. READY TO SAY “NO” WHEN NECESSARY :

One of the traits that

set Crorepati apart is their ability to say “no” when necessary,

especially in financial matters.

Crorepati is not afraid

to say no to people, even if it means disappointing them. They know that they

have to do what is best for them and their financial goals.

Saying NO when required

is a very powerful skill that helps Crorepati avoid unnecessary conflict and

financial regret.

Crorepati knows that

taking on too much risk can lead to financial ruin. That’s why they are careful

to evaluate all of their investment options carefully before making a decision.

Many times, we have seen

how a relative/neighbor/ friend who was doing nothing suddenly becomes a

Financial Expert once they become an Agent.

And they lure you into

Exotic products with all accompanying fancy brochures. And the vast majority

are obliged to fall into the trap of financial ruin by buying those products

which otherwise they would have NEVER EVEN CONSIDERED.

BE BOLD. BE READY TO SAY “NO”. After all, it’s YOUR hard-earned

money.

If you are in deep financial trouble, will these people come and help

you? No? Then why get into obligation and fall into a pit?

Avoid them like a plague, be bold, and say “NO” !!!

A vast majority also fall

into a financial trap when a friend/relative asks for a LOAN.

Being able to say NO,

especially to financial traps plays a highly crucial factor in the journey

towards Crorepati status.

10. HAVE A MENTOR

For many Crorepati,

having a mentor has been a crucial factor in their journey to financial

success. By having a mentor, you can learn new things, build your network, and

grow as a professional.

A mentor provides

valuable guidance and expertise, helping individuals navigate the complexities

of wealth accumulation. They offer insights based on their own experiences and

can steer mentees away from common pitfalls.

A survey by wealth firm Spectrem Group reveals that 85% of Crorepati with

more than $25 million have a Financial Mentor.

Having a mentor can be a

valuable asset on your journey to becoming a millionaire. If you are serious

about becoming a millionaire, I encourage you to find a mentor who can help you

achieve your financial goals.

Note: Having a mentor can be very helpful and beneficial, but it is not the

only factor. A mentor can provide guidance, advice, support, and inspiration,

but ultimately, it is up to the individual to take action and make the most of

their potential.

Becoming a Crorepati is

not easy, but it is possible if you are disciplined and persistent. Follow the

tips above and you will be well on your way to achieving your financial goals.

1. UNDERSTAND GOOD DEBT V/S BAD DEBT :

2. LIVE WITHIN YOUR MEANS :

3. INVEST DON'T JUST SAVE :

4. DIVERSIFY AND HAVE MORE INCOME STREAMS:

5. JUDICIOUSLY USE THE SALARY RAISE AND BONUS:

6. USE TAX LAWS TO MAXIMUM BENEFITS

7. FOLLOW ASSET ALLOCATION RELIGIOUSLY

8. UNDERSTAND THE POWER OF GOALS

9. READY TO SAY “NO”

10. HAVE A MENTOR

So…in short these are the

10 secrets. Make a note of them. Follow judiciously and see yourself on the

expressway to becoming a Crorepati.

Wishing you all the very

best on your Financial Journey.

Srikanth Matrubai

Author — Don’t Retire

Rich

Volatility Coach

You are strongly encouraged to consult your financial planner before making any decision regarding this investment.

The views expressed here are the author's personal views and should not be interpreted as a recommendation to invest/avoid.