FINANCIAL RESOLUTIONS FOREVER

As we welcome yet another NEW YEAR, I am sure many of you

are already planning your New Year resolutions, hoping for positive change. But

by the end of January, most of these resolutions are abandoned, lost in the

whirlwind of everyday life. It’s common for habits to slip back, no matter how

committed we are at the start. This year, let’s commit to something more

lasting—a resolution that doesn’t just get us through the year but lays the

foundation for a lifetime of financial security.

Instead of just a New Year resolution, let’s commit to an EVERGREEN

WEALTHY RESOLUTION, a mindset, an approach that if followed and implement

can guide you to a Super Successful Financial Life.

something you can carry with you for the rest of your life. By incorporating

this mindset, you’re not just planning for a single year—you’re creating

lasting wealth and financial security. These resolutions aren’t just short-term

promises; they are lifelong habits that will help you retire wealthy, rather

than just having a good income.

So, are you ready to make YOUR FINANCIAL LIFE step into a

new, wealthy version of yourself?

Yes?

Right then…

Here’s a roadmap for financial success that’s simple, practical, and easy to

stick to!

1) Plan Early for Big Expenses:

One common mistake many people make is neglecting to plan

for big-ticket spending. We tend to get surprised when large expenses pop up—be

it wedding expenses, children’s education, or buying a house. But here's the

thing: You don’t need to scramble for cash when these expenses come.

LONG TERM BIG EXPENSES can wreak havoc on your entire financial life if not adequately

and properly planned for. … whether it’s buying a house, funding your

children’s education, or retirement.

Without specific goals, you’ll end up wandering aimlessly. Once you have your

goals, create a clear strategy with the help of a professional advisor to

choose the right asset classes. Whether it's equities, bonds, real estate, or

gold, each has a role in helping you achieve your goals

While most tend to get planning correct for LONG TERM BIG EXPENSES, they just ignore

the small recurring expenses which can HURT in a BIG WAY if left unplanned.

In fact, we strongly encourage you to plan for the regular recurring annual big spends like:

- School

fees in April-May: Imagine your child's school fee is a recurring

annual exam. You wouldn't wait for exam day to start studying, would you?

Similarly, start setting aside funds for school fees in advance.

- Festival

spending during Diwali: Diwali is like a grand celebration, but it

shouldn't leave you financially drained. Start saving for Diwali expenses

throughout the year, like a disciplined guest who brings a small gift to

each party.

- Annual

vacations or family holidays: Vacations are meant for relaxation, not

financial stress. Treat your vacation fund like a piggy bank, consistently

adding small amounts throughout the year, so you can enjoy your trip

without worrying about the cost.

- Insurance

premiums due each year: Insurance premiums are like your car's service

– essential for its smooth functioning. Plan for these annual expenses in

advance, just as you schedule your car's service to avoid unexpected

costs.

Strategic planning helps avoid selling your investments at a

loss or, worse, getting trapped in a loan cycle.

Be clear on your goals, then create a strategy to reach them. Only after

this should you consider which investment products suit your needs.

2) Avoid EMIs Like the Plague (rather COVID!):

The “Buy Now, Pay Later” scheme is a trap, and it’s the

biggest hurdle in building wealth. EMIs drain your savings and eat into your

ability to create long-term wealth

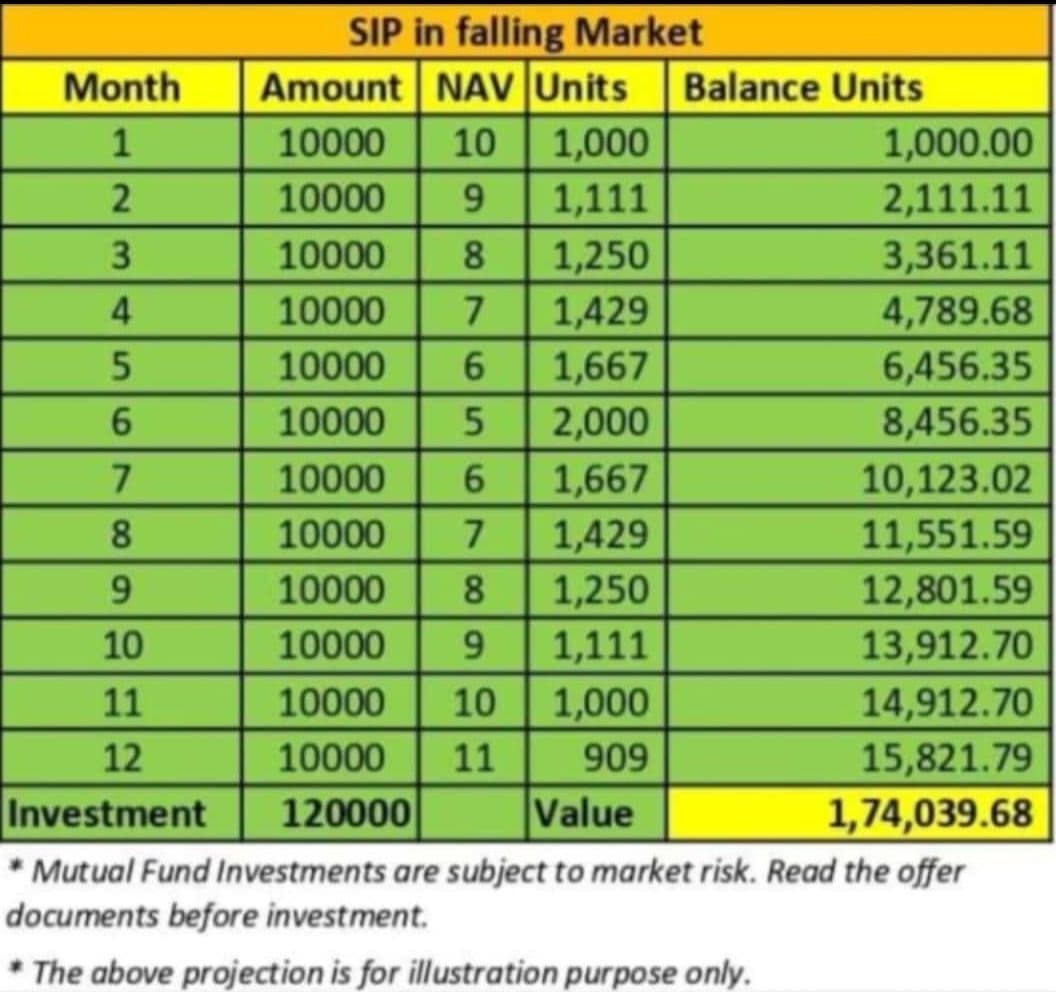

Instead of an EMI, think of a Reverse EMI—you invest

in SIPs (Systematic Investment Plans). These monthly investments grow

over time and can help you buy that luxury car or dream home with your own

money, rather than relying on debt. The satisfaction is unbeatable when you

purchase things with the wealth you’ve earned and grown. It's like baking a

delicious cake from scratch – the effort and time invested make the final

product all the more rewarding.

3) Get Covered by Emergency Funds and Insurance:

Before jumping into investing or saving, your priority

should always be protecting your family. Health insurance, Life insurance, and

an emergency fund are the bedrock of financial planning.

We saw the importance of an Emergency Fund during the pandemic. Now, you know

how essential it is to have a cushion for medical emergencies, job loss, or

unexpected expenses.

But don’t stop there—insurance is the unsung hero of

personal finance. Think of Term Insurance as your financial safety net

for your family. In case of an unfortunate event, it will provide for your

loved ones. It offers high coverage at a low cost, so you don’t have to worry

about your family’s financial future. It's like a sturdy umbrella that protects

you from the unexpected downpour of life's uncertainties.

4) Get an AMG (Advisor, Mentor, Guide):

Navigating through a dense forest without a map or guide is

a sure shot recipe for disaster. You are more than likely to probably get lost!

The same applies to your finances.

An AMG (Advisor/Mentor/Guide) will act like a map in a dense

forest—guiding you in the right direction, helping you make the right financial

choices based on your goals and risk tolerance. Your AMG (Advisor/Mentor/Guide)

will help you scale the wealth ladder faster and without stress.

The Google approach can’t replace personalized financial

advice. With thousands of mutual funds, stocks, bonds, and schemes to choose

from, it can be overwhelming to know where to begin. It's like trying to find

the perfect recipe for a gourmet dish by randomly combining ingredients – it's

unlikely to turn out well. Your AMG will tailor a plan based on your risk

tolerance, investment horizon, and asset allocation.

An AMG can help assess your risk tolerance and guide you to invest in products

that match your comfort level—be it **low-risk bonds**, **moderate-risk hybrid

funds**, or **high-risk equities**.

5)

Avoid Procrastination, Embrace Self-Discipline :

It’s easy to fall into the trap of saying, "I’ll

start tomorrow," but true financial success comes from consistent

discipline. It’s like climbing a mountain—you can’t reach the top in one leap,

but with each step, you get closer. Set clear financial goals and break them

down into manageable tasks. Each step you take gets you closer to financial

freedom.

Think of it like training for a marathon. You don't just run

the entire distance on the first day. You start with short runs, gradually

increasing the distance and intensity. Similarly, start with small, achievable

financial goals and gradually build on them.

Each small step moves you closer to your ultimate goal—financial freedom. The

key is to start now—the longer you wait, the harder it becomes to build

lasting wealth.

6) Beware of Lifestyle Inflation:

Just because your income increases don’t mean your spending

should. Inflation is like a silent thief that erodes the value of your money

over time. Remember Money in Cupboard is safe, but it’s also losing value every

year. Start to focus on investments that can outpace inflation.

It makes Zero sense to keep your savings in a savings account earning just 3-4%

per annum when inflation is running at 6%.

For instance, if your goal is to buy a house 10 years from now, keeping your

money in a fixed deposit won’t be enough. Equity and mutual funds,

though more volatile in the short term, tend to deliver returns that beat

inflation over the long haul.

In a sense, almost everyone is aware of Inflation but few are aware of

LIFESTYLE INFLATION.

The temptation is to buy bigger cars, fancier gadgets, and more expensive

items. But the best use of any extra income is investing it wisely.

Rather than spending on luxury items that will collect dust

in a few months, invest in improving your skills, health, or retirement fund.

That extra income could be your ticket to financial independence—use it wisely.

It's like a gardener who carefully selects the best seeds for their garden,

knowing that they will yield the most bountiful harvest.

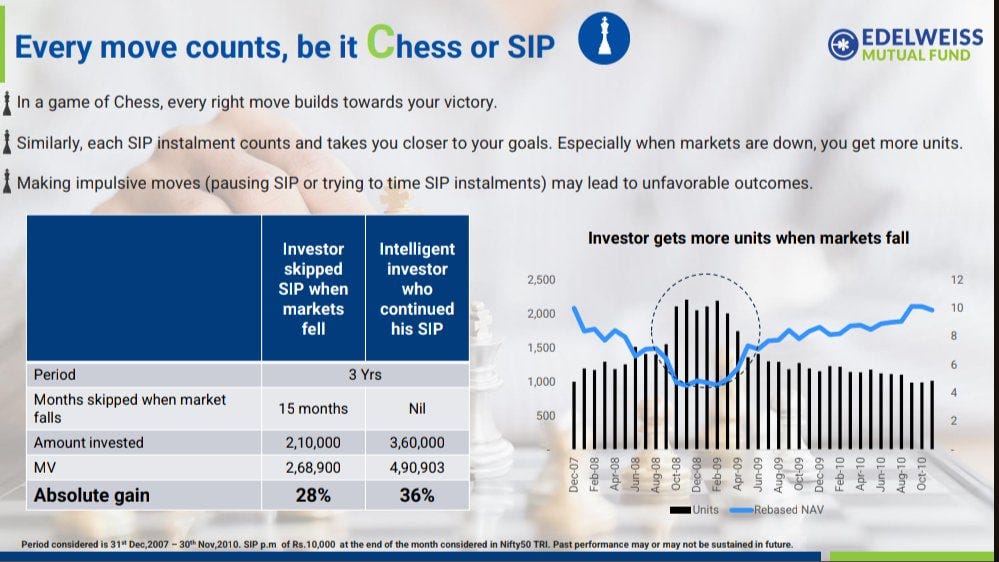

7) Invest for the Long-Term, Not the Quick Win:

Just like investing in a sapling and nurturing it, long-term

investments in equities, mutual funds and real estate require patience. Chasing

quick wins or trying to time the market is like planting a tree today and

expecting fruits tomorrow. You just cannot expect it to happen. NO Sir…..not at

all possible.

That’s why its make all the more relevant to focus on a long-term strategy and allow your

investments to grow over time.

Patience is key. Keep a steady hand on your investments, and

they will bear fruit when the time is right.

It's like a seasoned winemaker who patiently ages their wine, knowing that time

will enhance its flavor and value. That’s why staying calm and sticking to

your strategy is crucial, no matter what’s happening in the market. If you

panic and withdraw during market corrections, it’s like stopping a race midway.

8) Review Your Portfolio Annually:

Don’t just set it and forget it. Just like you have your Car

serviced every year to keep it smooth and in running condition, an investment portfolio

review is mandatory to make appropriate adjustments/changes to the changes in

your financial situation and even gaols

Over time, your goals may evolve, and so should your investment strategy.

Review your portfolio annually to ensure it's aligned with

your changing needs and market conditions.

9) Embrace the Power of Compounding:

Compounding is the silent wealth creator. Think of it like

adding a layer of bricks each year to build a skyscraper. The more time you

give your money to grow, the more it multiplies. Reinvest your returns, and

watch your money grow exponentially. SIPs and long-term investments are great

vehicles for compounding.

Compounding is like planting a small seed that gradually

grows into a majestic tree. The earlier you plant the seed and the more you

nurture it, the larger and stronger the tree will become.

10) Tax Efficiency Is Crucial:

In India, tax planning can make or break your financial

success. It’s not just about saving taxes but about investing wisely in

tax-efficient instruments like ELSS or PPF. Be sure to take advantage of these

options to maximize your returns.

Tax-efficient investing is like having a good umbrella in the rain—it shields

your wealth from unnecessary reductions. Talk to your advisor about the best

ways to minimise tax liability while building your wealth.

Tax planning is like choosing the most fuel-efficient car

for your journey. It helps you reach your destination with minimal fuel

consumption and maximum savings.

AND MOST IMPORTANTLY,

Focus on Health &

Fitness

Just as a strong body is essential for a long life, managing

your health is an investment in your future. You wouldn’t spend all your time

and money on building wealth without caring for your health, right? The

healthier you are, the more productive and financially secure you can become in

the long run. Eat well, exercise regularly, and invest in your physical

well-being. Invest in your health, because without it, wealth means little. A

healthy, energetic body allows you to work smarter, be more productive, and

enjoy your financial achievements with greater vitality.

TO CONCLUDE:

Financial fitness isn’t a New Year’s resolution that fades away by

February. It’s a lifelong habit—an evergreen wealthy resolution.

Just like Charles Duhigg, author of The Power of Habit, says, "Focus

on these small wins so you can make gradual progress." Wealth

creation isn’t about grand gestures; it’s about the small, consistent decisions

you make every day.

As Buddha wisely said, "No matter

how hard the past, you can always begin again." Today is the

perfect day to commit to these principles and lay the foundation for a

prosperous financial future.

Your journey to lasting wealth starts now. Don’t wait until

tomorrow—start today, and you’ll build a secure, financially fit future that

lasts a lifetime.

Wishing you all the very best and only the best.

Regards,

Srikanth Matrubai

Author – DON’T RETIRE RICH

AMFI Registered Mutual Fund Distributor

QPFP – Qualified Personal Finance Professional.

You are strongly encouraged to consult your financial planner before making any decision regarding this investment.

The views expressed here are the author's personal views and should not be interpreted as a recommendation to invest/avoid.

.jpeg)