Greetings,

Let’s

say that you are fasting just like that… you say “Not feeling like eating... I will not eat today” and there

is no specific motive for avoiding food.

And wow… in front of you, your best friend opens his Lunch Box and

there you see your favorite Pizza… 99 out of 100 times, you will

lose your resolve, succumb to the tempting yummy Pizza and go ahead to munch on

the cheesy delight breaking your fast!

Do you know why this happened?

There

was no clarity on the PURPOSE behind the fast and thus getting lured and swayed

by the yummy food is natural.

But

if you were fasting due to a religious belief…say Ekadashi, Dasara

festival, or a Ramzan, you wouldn’t get tempted come whatsoever as there

is a CAUSE behind your action.

The

strength behind you maintaining your fast in this case remains resilient and

you wouldn’t budge no matter how tempting the Panner Butter Masala may be as now

you have a PURPOSE and a REASON behind the fasting.

Without a clear purpose behind your fast, you are more

vulnerable to being influenced by enticing options that appear in front of you.

Likewise, having no specific financial goal for your savings can

lead to reckless spending or diverging from your investment plan when

attractive but unplanned expenditures arise.

=======================================

We

keep meeting all varieties of Investors. Some are truly well-intentioned but

still not able to create Wealth.

Let

me give you an example.

Last

week, I had a new investor through a reference. He said “Sir, me and my wife do save

religiously. We save for months but suddenly something comes up and we end up

using not only our savings but even our Credit Card. We assure you, Sir, we both

are SAVERS and not at all spendthrifts”

They literally begged, “Please help us

ACTUALLY SAVE”!!

This

was not peculiar to me at all.

This

happened to them as they did not have a FINANCIAL GOAL in Mind.

While every one of us is driven by Financial Aspirations and a promise of a better

tomorrow, somehow the bag of money saved vanishes when an Amazon Prime Day

Sale comes up or one of our cousins puts up a photo on Instagram

enjoying a Scuba Diving in the Maldives and lo! We too must do

the Scuba Diving or similar and end up spending ……totally unplanned!

The

Key to Successful Saving (and investing) lies in linking these to Well-defined

Goals.

You

first need to understand “WHY YOU NEED MONEY”

Just saying “I need lots of

money” is not enough.

Answer the WHY… Know the purpose and the reason for needing the money.

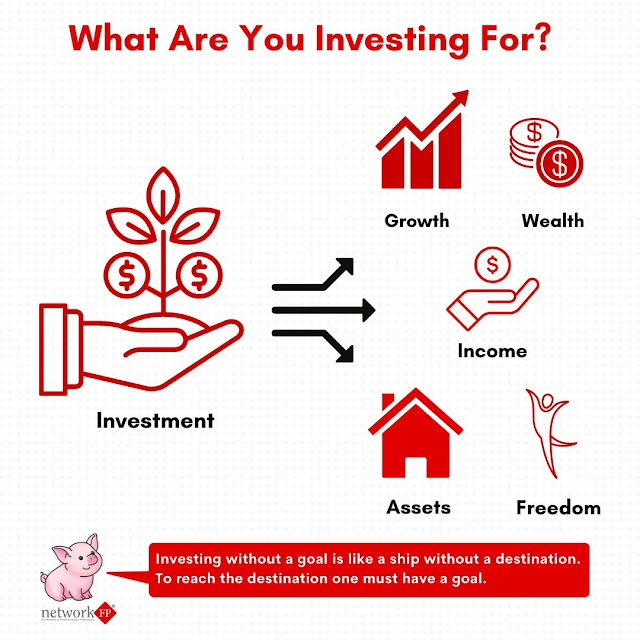

WHY DO WE NEED MONEY?

The

need for money could be varied and needs to have a target. It could be anything

like a wish fulfillment, making your life better, lifestyle expenses, or reducing

loans! It could be anything.

To

make it easier for you, I have listed some here.

To

get rid of a Loan (Home loan, Education Loan, Personal Loan)

To

start a new business, a new factory, a new branch

To

travel, to explore new places.

To

plan for kids’ future (education, wedding)

To

plan for my own RETIREMENT!!

When

you know why you need the money (purpose), you will be in a better position to

make the BEST USE OF RESOURCES you have to achieve Financial Freedom

The

goals can be anything. It could be your Annual Vacation, your new car, or your

down payment for that dream home. Now that the goals are linked, you will find

a purpose, motivation, discipline, and direction for your savings.

Visualizing you achieving your goal will keep you motivated enough and ensure

you don’t redeem that FD / Mutual Fund which is growing quite well.

This

linking of goals will also make you more motivated to find ways to increase your percentage of savings and maybe even your ways of

increasing your income!

And once you achieve a Goal, it

will give you that confidence that yes… you can do it. It will give you a sense

of fulfillment and reaffirms your own ability to take control of

your financial life.

THE MORE SPECIFIC

YOU ARE, THE BETTER

In

fact, having a SPECIFIC goal will help you not only visualize better but be motivated much more in saving and achieving that goal.

For

example, I want to buy a car

is a goal but “I want to buy a 6-seater Toyota

SUV is very specific”.

This

will give you an idea of “How much” is needed for that goal and “When” you can

reach that goal.

Begin

with Short Term Goals and then gradually go for Medium Term Goals and finally

the big ones. And that’s your Long-Term Goals

Setting

short-term goals is the perfect way to build confidence and establish a

foundation for greater success. Small

wins lead to big accomplishments!

Now

that we know the goal…it’s easy to PLAN.

Suppose you say I need Rs.2 lakhs

for my Singapore Trip 2 years from now. Good. Now that we know you need Rs.2 lakhs and we

have 2 years’ time.

It becomes now easy to calculate how much you should keep aside

every month for that Singapore Trip and you can achieve the same.

FOR THE LONG TERM TOO:

This

can and must be applied for the long term too.

Instead

of saying “I want to retire

rich”, you can

have a specific number in mind and say, “I want to retire with Rs.5 crores of Net worth”.

Now

that you know you need Rs.5 crores when you are 60 and suppose you are 35 now.,

you have a good 25 years to plan.

Let’s

look at an example.

Suppose

you start with zero (0) and start saving at age 35.

All you need is less

than Rs.30,000 per month! And now you know that 30k is enough for your 5cr retirement target

corpus, you can plan easily and direct savings to that goal.

Having

a financial goal will help you stay focused and be disciplined with your money.

It

gives you a reason to save, and invest rather than splurge on impulsive purchases.

With a goal in mind, you will

also be able to track your progress and celebrate the reaching of goals.

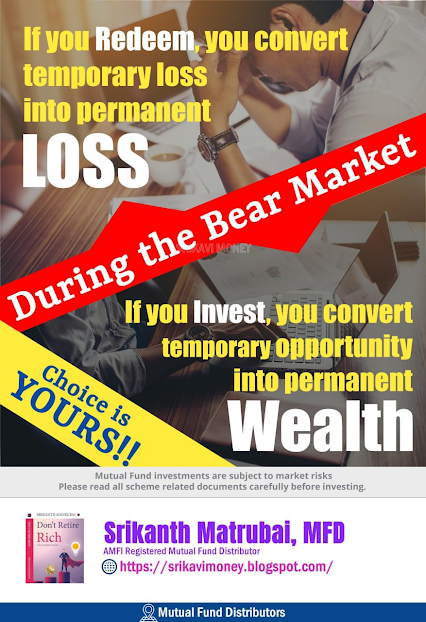

DON’T SAVE… INVEST!!!

I have seen many who save religiously but do not invest

wisely. Saving is only the 1st step but the 2nd and most crucial

step is INVESTING.

Saving is like putting your money in a Piggy Bank. It will

keep your money safe but will not grow due to the effects of inflation and taxes.

Investing is like planting a variety of seeds in a garden. The

seeds may and will take time to grow into plants and then trees but the effort

is worth it as you can reap the rewards regularly.

Investing is the right way to grow your wealth and reach

all your financial goals on time.

Yes… Investing is a difficult process especially when it comes to not only

identifying the right asset class but also the right instruments and the

percentage of amount that needs to divide among these many varieties

That’s where

the requirement of an Experience Investment Expert will come in handy. She will

help you navigate the market fluctuations, maximise returns without

compromising on risk by understanding your risk profile, asset allocation, and

guide accordingly.

THE BIGGEST ADVANTAGE:

Once the Goal/Purpose/Target is identified, automatically the WANTS will get

reduced and may even be eliminated as now the inner mindset will be focused on

reaching the goals.

Making

sure you INVEST the saved amount in Equities is what will ensure that you just

DONT RETIRE RICH but retire WEALTHY!!

So

don’t just save, invest. Saving is good, but investing is better. Saving

is necessary, but investing is smart.

Saving

keeps you safe in a cage.

Investing

will elevate your financial status and help you soar to new heights.

Invest…don’t just save.

THE ULTIMATE WEALTH CREATION TIP IS

a. HAVE A GOAL FOR YOUR SAVINGS

b. DON’T SAVE BUT INVEST FOR THAT GOAL

All the very best to your Financial Freedom Journey

Srikanth Matrubai

Author — Don’t Retire Rich

You are strongly encouraged to consult your financial planner before making any decision regarding this investment.

The views expressed here are the author's personal views and should not be interpreted as a recommendation to invest/avoid.