RBI launched CBDC (Central Bank Digital Currency) on 1st December

What’s CBDC?

Is it like UPI?

Is it like Crypto?

What are the benefits, and how does it work?

Digital Currencies like the RBI CBDC is a digital form of a country's currency

So.. what RBI has launched yesterday is digital of our RUPEE

Central Bank Digital Currency symbol will be e₹ or e-rupee.

The E-Rupee by RBI represents legal

tender like your Bank Notes and unlike Cryptos this digital rupee is in the

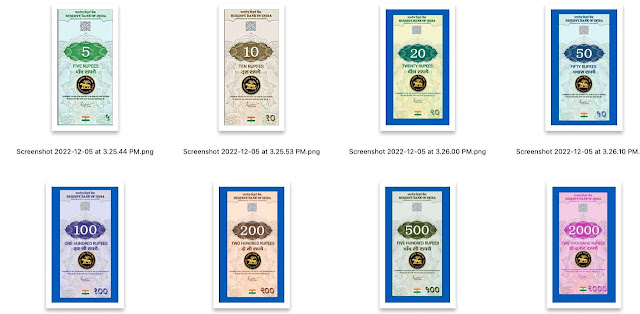

same denomination as your paper rupee and coins (

This digital

money shall also have RBI Governor's signature just how a currency note does

today.

Crypto has no issuer as such whereas

E-Rupee is issued by the RBI

Digital Currency, that is the CBDC is NOT

a new currency but just a digital representation of the Rupee.

Digital Rupee was launched by RBI as an

effective alternative to CASH and not just Crypto.

This Digital Rupee will use Block

Chain Distributed Ledge Technology

On the 1st day, that is 1st of December, Rs.211

crores ($26 million) of bonds were traded using the e-rupee

HOW CAN I USE THIS E-RUPEE AND FROM

WHEN?

First, you will have to open a DIGITAL WALLET ACCOUNT WITH THE RBI (via your Bank) using your Aadhar Number.

Once you register successfully on the app, you will be assigned a digital wallet with a unique ID. You can then load the wallet by transferring money from your bank account

Next, you ask your Bank to transfer money from your Bank account to the e-Rupee

Account. You will have to choose the denominations too (same denominations as the current paper notes and coins)

Next, start using! Use it to make

payments, and pay electricity bills exactly as you use your Physical Paper Currency

Note.

For now. what has been launched by the

RBI is a "pilot project" and is restricted to 4 cities and

just 4 banks.

Gradually this will be expanded after

fixing any glitches that could be seen and will make available to the layman

like you and me

IF THIS WORKS LIKE PAYTM, GOOGLE PAY, WHY SHOULD I USE e-RUPEE. WHAT IS THE ADVANTAGE?

Good question.

Just like your Paytm, Google Pay, Bhim

UPI, you can make payments using the E-Rupee to merchants using QR codes and

even Person to Person

All payment apps like Paytm, Google Pay, etc need to have a backup in the form of a Bank Account (that is your money should be there in the bank if you want to make a payment) but ….

in CBDC you have a Digital Wallet which could have money taken from your different banks (ex.. Axis Bank, Yes Bank, SBI) all into 1 single Digital Wallet.

So for example, suppose I take Rs.100 from Axis, 100 from Yes, and 100 from SBI and use this Rs.300 to spend/pay on anything I want. No intimation to Bank will go and thus the Bank is completely eliminated when I am using Digital Wallet (CBDC)

E-Rupee

CBDC actually ELIMINATES THE NEED FOR a BANK ACCOUNT! (This could be a game changer

and could even gradually kill the banking industry over a period of time)

So, a Bank Account is mandatory for

you to use the payment apps like Google Pay, and Bhim UPI, but for the CBDC e-Rupee

Bank is NOT required.

What you need is a CBDC Digital Account and here no Bank is involved

This will help foreign tourists in shopping without much cash in hand since they don't have bank accounts in India, UPI was still not used by them, but now they can use CBDC

Thats why you would have noticed that sometimes your UPI payment fails but with DIGITAL E-Rupee the failure chances are NIL as you are actually giving money yourself without relying on your bank (it's like giving cash to the opposite person)

MOST IMPORTANT :

Since CBDC Digital Currency e-Rupee is universal and not a payment app, it will be accepted EVERYWHERE (at all merchant shops) and no shops/seller will give the excuse of "I dont have Paytm...I dont have Phonepe..give me cash" !!!

**********************************************************************************

Just like UPI (Bhim UPI, Google Pay,

Paytm) the E-Rupee also lets you transfer money instantly without needing the

other person's bank details

Users will be able to transact via an E-wallet offered by Banks via mobiles and devices

Person to Person (P2P), Person to

Business (P2B), via the QR codes

e-Rupee has the same benefits as the

daily cash that we use

***************************************************************************************

MOST IMPORTANT:

When we keep our money in Bank, say a

huge amount like Rs.1 crore and the Bank goes bust, unless it's an FD, your money

is completely gone!

Even in a FD, only Rs.5 lakhs is

guaranteed by the RBI

but when you keep money in the CBDC e-Rupee your entire amount of Rs.1 crore is

GUARANTEED to stay as the CBDC e-Rupee account is with the RESERVE BANK OF INDIA

and not with any Bank. Yes… CBDC e-Rupee is managed by the Baap of all Banks, that’s

the RBI, and its as safe as your money can get!

*******************************************************************************************

CRYPTO V/S CBDC e-RUPEE

Crypto is not represented by any

underlying asset

Whereas the e-Rupee is represented by the

RBI

Cryptos are a form of digital assets and NOT a form of payment.

Crypto is volatile and keeps going up or down

CBDC is definitely a safer alternative

to Crypto as it's backed by Sovereign and the launch of CBDC by all central

banks could even eventually kill the popular cryptos like Bitcoin.

And yes, your e-Rupee can be exchanged

with the actual paper Rupee!

Unlike Cryptos (Bitcoin, etc) whose

value is volatile, the CBDC by RBI will have a FIXED equal to the Indian Rupee

and moreover backed by the Central Bank and is thus a Risk-Free proposition

Thus, CBDC like our e-Rupee has all the advantages of crypto with the additional greatest advantage of being backed by the Government.

TAXATION:

All cryptocurrencies like Bitcoin,

Ethereum, Litecoin, etc., is taxed heavily including TDS

Only RBI’s digital rupee will be free

from tax regulations.

INTEREST:

No. You will NOT get any interest for

keeping your money in the form of an E-Rupee. So, even if you keep 1 crore...it

will continue to be Rs.1 crore even after a period of time (say 1 year) as the

E-Rupee will NOT generate interest on the amount kept idle

(this may change later by RBI but for now, this is the rule)

Will the e-Rupee become popular?

Because the e-Rupee is backed by the

RBI, the government is sure to make this popular, and thus we will be seeing

more and more of the e-Rupee in the coming months and years

6500 crores spent

by RBI to print which is definitely a massive waste

The growth of the e-Rupee will eliminate

this cost and a huge saving for the RBI and the Government

And of course, the e-Rupee will

eliminate the counterfeiting

Demonetisation did not kill cash but the e-Rupee could well do it!!

All the best,

Regards,

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/

No comments:

Post a Comment