The New Mercedes Sales Head

STOP SIP AND BUY MERCEDES IN EMI!!

He wants to bring the American Culture of living in DEBT (EMI) throughout out and then slog day and day

What matters is WEALTH first

Luxury comes

by default

Investors

should focus on Creating Wealth

Not showing

Luxury by buying a Merc on EMI and keep slogging for the next 5-10 years paying off

the EMI

And why

should a layman buy a depreciating asset to just show off rather than CREATING

Assets and Getting himself Financially secure with an Equity Mutual fund where

his wealth is growing.

And an EMI

into a Mercedes is not only bringing my asset price DOWN but also has OTHER

expenses like the Annual Maintenance, Insurance, etc

DEPRECIATING ASSET:

Mercedes

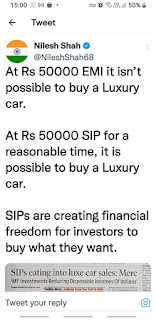

people don’t even know that a 50k EMI will give

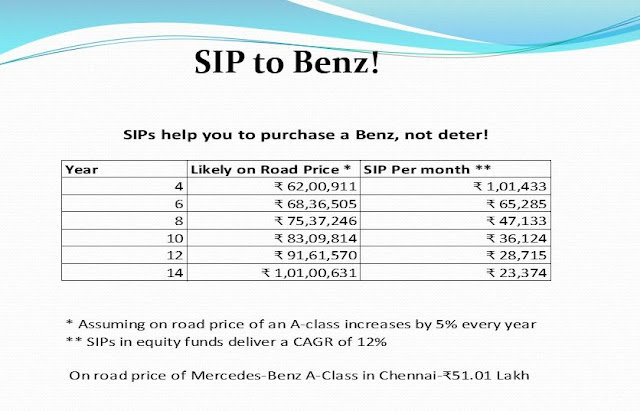

At 12% returns, this is what a Rs 50,000 monthly in SIP can do

over the years –

5 years of Rs 50,000 monthly SIP = Rs 42 lakh

10 years of Rs 50,000 monthly SIP = Rs 1.1 Cr

15 years of Rs 50,000 monthly SIP = Rs 2.5 Cr

20 years of Rs 50,000 monthly SIP = Rs 4.8 Cr

The cheapest Mercedes comes at a cost

of 50 lakhs and with all accompaniments will easily cost Rs.60 lakhs when it

lands at your doorstep.

Moreover, its huge annual Maintenance and Insurance costs mean you need a backup of Rs.2 lakhs annually

So, 7 years of SIP will get you

Mercedes (and this is the cost of Mercedes SAME at that point in time!!)

If Mercedes is indeed getting affected by Mutual Fund SIPs, they are knocking

at the wrong door

Actually, only 4.5% of India's population invests in Mutual Funds, whereas nearly 50% of

the money is actually going into the MOST ILLIQUID ASSETS .... Property

and 15% is

into FDs

Let the Mercedes

team tackle the EMI in property, they will be much better off

Maybe the

Mercedes MD will say Your HOME EMI is our competition.... please stay under the

flyovers and roam around in a Merc!!!

EMI HAS BECOME AN HABIT

EMI, especially the Home Loan EMI has become an HABIT engrained deep into the

Indian Middle Class DNA

The thinking (obviously, wrong thinking) is that EMI for a Home is good and gets

respect from Friends and Relatives

Breaking this

Home Loan EMI for Mercedes is proving next to impossible so he is looking for

Low Hanging Fruits which is obviously is Mutual Fund Sips

JIM CRAMER EXAMPLE

Host of the popular CNBC shows in America "MAD MONEY" and "INVESTING

CLUB", Jim Cramer lived in his 2nd hand small car Ford, stayed disciplined

with his investment and Jim says, his investment in Equities via Mutual funds

made him a Multi-Millionaire and NOT BUYING LUXURIES TO SHOW OFF.

His advice which he himself religiously followed was

"Your first $10,000 (approx.

Rs.8 lakhs) must compulsorily go into Equity Mutual funds and only AFTER THIS

wherever you want!”

Our Indian

Mutual Fund Investors focus is on BUILDING WEALTH not SHOWING OFF UNWANTED

LUXURY WITH BORROWED MONEY!

They are not #PaisaWiseRupeeFoolish

Indian

Investors have decided that they "DONT RETIRE RICH"

Indian

Investors are now guided by "WOW=WEALTH OF WISDOM"

We believe

that Happiness is not in roaming around in Mercedes but in having an EMI-FREE

LIFE!

The peace of

a Debt free life is heavenly and irreplaceable

BEING FRUGAL

is one of the secrets of Wealthy People. It’s a vital #WealthyHabits

Mark

Zuckerberg worth $33 billion drives a $30k Volkswagen GTI car

Google

co-founder, Sergey Brin still shops at Costco

Wipro

Chairman, Azim Premji still drives an inexpensive car.

No need to

impress people with your richness. What matters is YOUR COMFORT.

Period

We MFDs

are the AMG to our investors

AMG = Advisor /

Mentor / Guide

Just because

we make them save doesn’t mean we ask them to LIVE POOR AND DIE RICH

We

definitely make sure that they enjoy life, and have all the luxuries but all this

with PEACE OF MIND

And this

Peace of Mind comes NOT WITH ANY EMI but 100% this Peace of Mind comes when you

have a DEBT FREE LIFE AND OWN ASSETS WITH YOUR MONEY

That’s exactly what we educate

That’s exactly what we aim

That’s exactly what we help our investors achieve!!

SIP IS

WEALTH CREATION

EMI IS

WEALTH DESTRUCTION

EMI kills

SIP thrills

Do REVERSE EMI by investing in

SIP

WHY SIP and why not an EMI....

Lets see the points...

1.

By investing in SIP...you are actually CREATING a corpus wherein you can buy

ASSETS with your own instead of BORROWED future earnings which can be hugely

stressful.

Know what....SIP will also help you benefit from COMPOUNDING and actually

create WEALTH

An EMI will do the reverse......your money is GONE....the asset you bought is

depreciating and the all the future earnings are not being enjoyed by you but

going to service the EMI.

2.

One of the worst decisions that many make is

TAKING A VEHICLE ON EMI

By the time your EMI ends (normally 3-5 years), the price of the vehicle would

have become more or less ZERO due to depreciation and you need to go for an EMI

again!!

3. A Sip can always be STOPPED in between in case of any financial difficulties

you may have but an EMI cannot be stopped. If you skip paying any EMI...the

charges and penalty are levied and you are burdened even more!!

Think TWICE before going for an EMI

Which is better?

EMI or SIP?

What kind of person you are, determines which to choose.

Is it?

You :

Save, only where there is a forced liability-EMI

Save, with a purpose and goal in mind-SIP

Save, only to meet a Lifestyle-EMI

Save, to meet Your Life Goals-SIP

Asset depreciating, in Value-EMI

Asset appreciating, in value-SIP

There are many.

You decide.

You choose.

EMI or SIP :-)

SIP IS A GOOD EMI

Do not stop your SIPs during times when market

comes down.

Keep continuing your SIP. You get allocated max

units when market comes down.

Which, in turn, gives you the highest return when

market goes up, which it eventually does.

SIP helps you

1. in Developing Financial Discipline by inculcating the habit of SAVING.

2. Your Financial dreams can be achieved with your OWN money and not borrowed

money

3. NO STRESS!!!!!!!!!!!!

EMI results in DEBT

4. NO need to worry about Market Levels as SIP buy MORE at lower levels and

buys less at Higher levels.

5. Helps you to enjoy POWER OF COMPOUNDING

6. VERY IMPORTANT - WITH AN EMI, YOUR COST IS ALWAYS HIGHER. WITH A SIP, YOUR

COST OF A PRODUCT THAT YOU PURCHASE IS ALWAYS AT ACTUALS and sometimes even at

a Discount as a Seller always prefers Immediate Money and Later Money (like an

EMI).

7. In an EMI....you PAY interest...

In a SIP........you EARN Interest

8. You have NO control once you take the EMI....

For every little change in your life like changing a job, changing your

residence, or buying another asset....you will have to think so many times due to

your unavoidable, must-pay EMI

9. Control over Asset Allocation.

Once you have taken EMI...you cannot change the Asset and the debt outgo will be

there

With a SIP, you can always control where to invest (Equity, Debt funds, Gold

funds, International Funds, etc)

EMI is

PRISON

SIP is FREEDOM.

Indians have

now learnt and understood that its better to invest in APPRECIATING ASSETS

(Equities) and not DEPRECIATING ASSETS (Cars) !

There is a

saying

"WHEN

YOU HAVE THE MONEY TO BUY 7 CARES, THEN YOU BUY YOUR FIRST CAR”!!

I have a simpler version of this

“WHEN YOU HAVE CASH

(SURPLUS MONEY) TO BUY DOUBLE THE COST OF WHAT YOU ARE BUYING…THEN YOU CAN GO

FOR IT”

A Luxury car

like a Mercedes comes only AFTER you have bought (or provided for) important

financial goals like Children’s Education, Children’s Marriage, Own Home,

Retirement Corpus, your Healthcare Corpus, etc. You need a car to transport

from 1 place to other and if a simple Maruti/TATA car do, why do you need a

Mercedes Benz unless you want to show off?

MERCEDES, PLEASE

KNOW THIS…

It’s only the SIP investments that

create wealth and later lead them to buy more Mercedes. So, stop barking at the

wrong door!!

Don’t cut

down the tree giving you fruits!

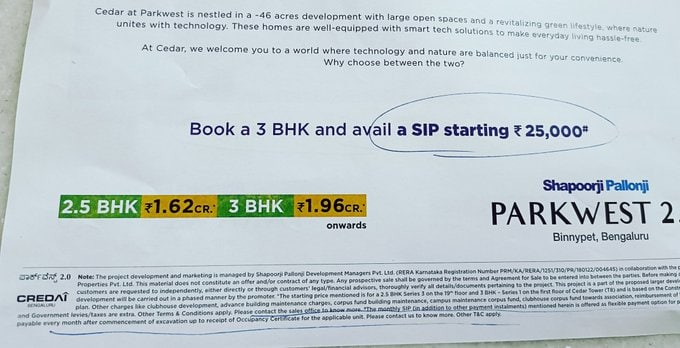

Remember the above image

Again its an EMI but the Real Estate Developer cunningly uses the word SIP

So...friends, beware SIP is under eyes of Destroyers of your Wealth

SIP is the panacea for your financial goals. You only get stress, fear, and false pride by Showing Off.

Don't Retire Rich, Retire Wealthy by adapting Wealthy Habits and Wealth Of Wisdom

All the best

Srikanth Matrubai

Author - Dont Retire Rich

and

WOW-WealthOfWisdom

All the best,

Regards,

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/

No comments:

Post a Comment