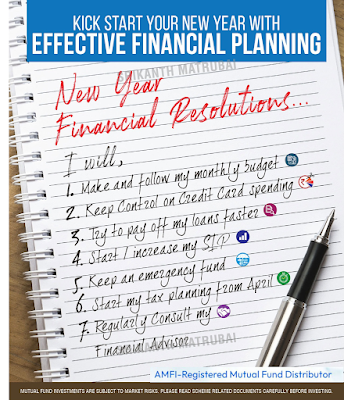

One thing that almost everyone does in the last week of December is to pledge a NEW YEAR RESOLUTION....And then by the end of January, 90% of this goes up in smoke!

After all, changing

habits is not easy it needs constant reminders, which explains the failure to keep up with the resolutions and subsequent BACK TO SQUARE ONE!

Hence it's prudent to have an EVERGREEN WEALTHY RESOLUTION rather than just a NEW YEAR RESOLUTION

We have seen

laymen getting into Resolution Pledging mode with huge

excitement promising

themselves they WILL stick to it.

But how many

do?

Less than

10%

Are you in

that rare 10%?

Great

If you are

not...it’s better, you get into the mode and scale up yourself.

Yes...

It's indeed

super difficult to CARRY through a new habit after a few days as so many tempting

things keep popping up.

Give it a

TWIST

Instead of

having a Resolution only for the New Year why not have a Resolution for a NEW

WEALTHY YOU!!

Yes. Just

change the track. Get into a habit of sticking to a resolution that you can

easily stick to throughout life and then see your life move from average to good

to better to BEST LIFE

So… Ready?

Here we go on the WEALTH RESOLUTIONS that you have to stick to throughout your life so that you #DontRetireRich but the #WealthOfWisdom that this article shares.. will elevate you to RETIRE WEALTHY

What’s

shared is SIMPLE AND VERY EASY TO FOLLOW

Something so easy that you will feel that I think I am already doing it.

But...you

are not!

Maximum miss

out

1. PLAN EARLY FOR BIG

SPENDS

Identify the

big-ticket spending and plan to save towards the same.

Yes... many

do plan for Big-Ticket spending like Marriage,

Owning House, etc

To simplify

your life even further, plan early for even the ANNUAL Big Spending like the

School Fees in April-May

Festival Spending in October-November

Annual Vacation

Insurance Premiums

This will

help you plan your cash flows and avoid selling your good investments and God

forbid...getting into loans

"With strategic planning, turn your goal pursuit from a mad dash to a joyful journey. Enjoy the journey, make wise choices, and get to your goal feeling confident and ready. 🚀

2. AVOID EMIs LIKE A

PLAGUE (rather like COVID!)

The

Buy-Now-Pay-Later is a scheme that is the BIGGEST hurdle in you moving up the

WEALTH scale.

Avoid the

EMI like a Plague (rather like Covid)!

Use CASH

always...this will straightaway keep you out of getting into an EMI trap.

Unless it’s

a Home Loan EMI, you have no right to get into an EMI and get yourself trapped

and shave off your wealth.

EMIs reduce

your cash savings and consequently, your money which was supposed to create

Wealth for you and your family is now going to service debt thus postponing

your Wealthy Retirement Life.

EMI kills

SIP thrills. Do REVERSE EMI by investing in SIP

Invest in Equity

Mutual funds via SIP (EMI in Reverse) and buy that Luxury Product with YOUR OWN

MONEY.

The satisfaction will be unparalleled

(Read this useful blog

DO REVERSE EMI TO BUY YOUR MERCEDES!

https://srikavimoney.blogspot.com/2022/11/do-reverse-emi-to-buy-your-mercedes.html)

3. GET COVERED BY

EMERGENCY FUNDS AND INSURANCE

Earlier I

had to take huge pains to explain the benefit of the Emergency Funds. The Covid

experience has now made even the layman understand the importance of the

Emergency Fund.

If you don’t

have an Emergency Fund, SET IT UP NOW!!!

Be prepared for Emergencies: Medical contingencies, job loss, and salary cuts

are some emergencies that you must be prepared for.

Sadly, the

layman continues to ignore the Insurance part (especially the Term Insurance

part).

Term

Insurance is a MUST, especially for a Bread Winner. Term Insurance offers the HIGHEST Life Cover at a Low Premium protecting your family from a financial crisis

in your absence.

4. Get an AMG

An AMG (Advisor/Mentor/Guide)

will help you scale up

the Wealth Ladder faster, quicker, and relatively stress-free.

The "I have Google"

approach has ruined the

finances of so many people and I have seen even the so-called highly literate

Tech Guys making blunders by investing in selecting funds and then losing HUGE.

The Internet

won't give you personalized suggestions. To build long-term wealth, always

follow your AMG…Advisor-Mentor-Guide

Having to

choose amongst 1000s of funds based on asset class, market cap, investment

style, etc, is indeed a herculean task

Selection

needs to be based on your risk profile, investment horizon, asset allocation, and

various factors as each fund serves a different purpose in a portfolio.

In such a scenario, advice from an AMG

(Advisor/Mentor/Guide) is a must

Don’t become

a #PAISA WISE RUPEE FOOLISH

5. AVOID PROSTICANATION... EMBRACE SELF DISCIPLINE

It is critical to address indifference and a lack of discipline when it comes to money matters. The key to success is defining your financial objectives clearly and methodically breaking them down into doable actions. Establish a reasonable timetable for completion and reinforce your commitment by closely monitoring your own progress.

Instead of a "kal karenge" cliche, turn your mindset into a "samridhi forever" story. One step at a time, one chai at a time, climb Mount Everest in finance. ☕️

6. OVERSPENDING (LIFESTYLE INFLATION)

Your income may reach the summit of Everest, but your spending should not! A bigger income is not a license to live like an Ambani!

That Extra Income could be your ticket to Financial Independence.

Ditch the "more money, more things" mindset in favor of long-term goals such as financial freedom over that flashy new gadget that will collect dust (and regrets) in a month. Remember that true happiness rarely comes cheap.

Invest your extra income wisely, whether it's in improving your talents, prioritizing your health, or supplementing your retirement fund. Today's strategic investments lay the path for a more resilient and prosperous future.

TO CONCLUDE ...

“Focus on these small wins so you can

make gradual progress,” Charles Duhigg, author of “The Power of Habit” and a

former New York Times writer, said. “If you’re building a habit, you’re planning for the next decade, not

the next couple of months.”

“No one's ever achieved financial fitness

with a January resolution that's abandoned by February”

The

resolutions shared here are not for a year...it’s a VEDA VAKYA (GITA

FOR INVESTMENTS) for LIFE-LONG

The ideas

shared here are Meaningful, Measurable, and DOABLE.

"No matter how hard the past, you can always begin again."- Buddha

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/