Chase Consistency

Fund X is up by 50% in 2023!

Fund Y is up by 32% till now in 2024!

These headlines are enough to entice anyone. Let's acknowledge that financial markets carry more volatility than even a roller coaster. And especially in Bull markets, even donkeys become horses and jaw-dropping performance from the "Rip-Van-Winkle" funds is a given!

Before jumping in... remember the biggest disclaimer

PAST PERFORMANCE MAY NOT BE INDICATIVE OF FUTURE RETURNS.

While this disclaimer is valid for every asset class like Gold, Silver, Real Estate, and Equities...its more prominent in Mutual Fund performance.

Step back a bit and look at the bigger picture and consider a broader perspective, rather than just the short-term jump.

Do you Want to Invest in a High-Yielding FD or a Safe One?

Even as straightforward with fixed deposits, we do see different banks offer varying rates for similar tenures, with

cooperative banks sometimes offering double-digit rates.

Yet, we prioritize

safety and convenience over returns, don’t we?

Similarly, when investing in

mutual funds, where our principal itself is subject to fluctuations, it is

imperative to show even more diligence.

Constantly jumping in and out of funds

based solely on recent performance can lead to unnecessary costs, reduced

overall returns, and even greater risk.

The Danger of High Returns as One-Off Incidents

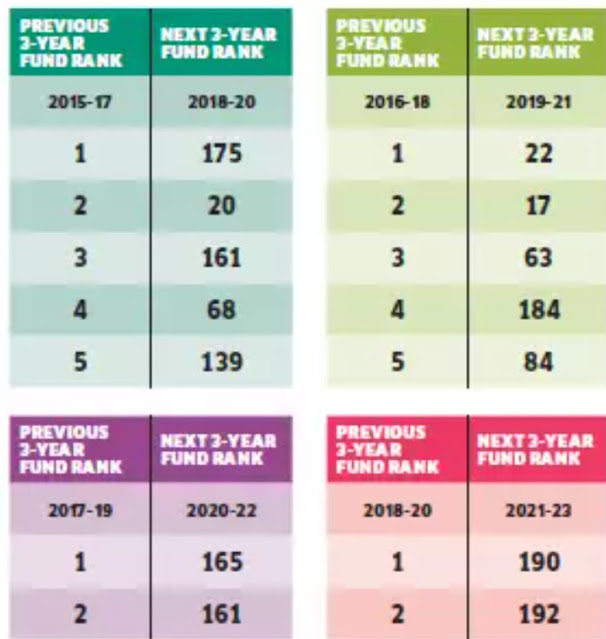

Past Performance should never be the sole criterion for selecting a fund. It can be very misleading. Past Performance is like a rear-view mirror showing only what has been rather than where you will be going!

The landscape for mutual funds keeps changing including the fund management styles. Add to that the market conditions and this is enough for a high flying fund to take a hit and be down for a longer period that you would like to.

Its always better to focus on alignment with YOUR Financial Goals besides the fund's investment strategy.

Rather than flashy short-term spikes, consistency should be given higher priority.

Just imagine a fund that delivers a 35% return in 1 year but follows up with 2-3 years of minus 20% loss, the initial gain which made you jump in joy could now lead you to desperation and even searching for an answer on how to arrange for your goals.

A mode modest consistent 12% return may look middle-class but due to compounding effect could potentially double your money in 6 years or even lesser period of time.

Different Funds Different Needs

Mutual funds come with different levels of risk and potential returns. Generally, higher returns are associated with higher risks. This means that you should be prepared for high volatility, similar to a roller-coaster ride.

Different funds perform differently over different time. Some will do well when economy is doing good while others shine in tough times. Hence Diversification is a MUST.

If you have a longer time frame to achieve your goal, riskier funds like Small Cap Funds might be suitable for you because they have the potential to generate higher returns.

Short-term goals should have lower equity exposure and safer funds to protect your principal.

HIGH RETURNS COULD WELL BE A FLASH IN THE PAN.

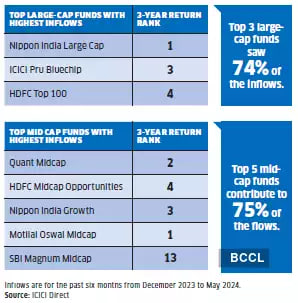

As seen so many times in the past, many mutual funds which are the Numero Uno

in returns could well be languishing at the bottom for many returns and could

well jeopardize your financial goal planning.

We have seen evidence in the form of JM funds in years 2008, 2009, and recently with

Axis funds during the 2020s

In the same breath, let me also make you aware of how JM

FOCUSSED FUND which was at the bottom for 15 years made a stunning bounce back

from 2022 onwards.

So. Even VERY LOW returns also does not mean that you shun the fund forever.

You should be flexible and agile to make sure you reach your financial goal without

having to sweat too much by sticking to CONSISTENT FUNDS.

Factors to make better investing decisions :

1. Quality of Returns: Look for funds that provide consistent returns over time, rather than those that have recently spiked in performance.

2. Risks Involved: Evaluate the risks associated with the fund and ensure they align with your risk tolerance and investment horizon.

3. Liquidity: Consider the liquidity of your investments. Higher liquidity means you can easily withdraw or transfer your funds, which is particularly important for riskier investments.

4. Category of Fund: Choose funds that align with your financial goals, investment duration, and risk appetite. Diversify across different categories and subcategories to balance your portfolio.

5. Alignment with Financial Goals: Ensure the mutual fund aligns with your specific financial objectives, whether it's early retirement, regular withdrawals, or long-term growth.

Additional Tips:

- Please keep the following points in mind:

- Regular Monitoring: It's important to keep an eye on your investments and review their performance from time to time. Make adjustments to your portfolio as necessary in order to stay aligned with your goals.

- Professional Advice: If you are new to investing, consider seeking the guidance of a financial advisor. They can offer personalized advice based on your financial situation and goals.

- Long-Term Perspective: Investing with a long-term outlook can help reduce the impact of short-term market volatility and take advantage of compounding returns.

Conclusion: Focus on Achieving Your Goals

Investing isn't just about maximizing returns; it's about building a future you're proud of. Focus on a strategy that aligns with your long-term goals and balances risk with reward.

Requesting you once again... please remember,

past performance is not a predictor of the future.

Follow this always :

Avoid making impulsive decisions based on short-term market fluctuations.

True investment success comes from understanding the underlying strategies, management teams, and consistency of your chosen funds.

Prioritize long-term growth over quick wins. By building a diversified portfolio and staying committed to your plan, you're well on your way to achieving financial security and peace of mind.

Consistency is key for long-term wealth creation. Building a strong foundation is important, not just chasing the next big thing. Although short-term fluctuations can be unsettling, remember that your investment horizon is likely longer.

Shift Focus from the Thrill of the Chase to the Rewards of the Journey. Chase Financial Goals and not the Past Winners

Remember, investing is a marathon, not a sprint. While it’s natural to

be drawn to the excitement of high returns, focus on building a portfolio

that’s built to last. By prioritizing consistency over short-term gains, you’re

taking a significant step towards achieving your long-term financial

objectives.

Regards & wishing you Super Financial Success

Srikanth Matrubai

Author: Don’t Retire Rich

Qualified Personal Finance Professional

AMFI Registered Mutual Fund Distributor

Note: This article is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions.

## Disclaimer

Remember, investing in mutual funds carries risks, and past performance is not indicative of future results. Always consult with a financial advisor before making any investment decisions.

Regards,

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/

No comments:

Post a Comment