But, if it does cross the Limit...then you better file the returns or you better be prepared to face the Music

OH MY

GOD! ANY OTHER IMPLICATIONS?

Yes.

Definitely.

1.

You will not be allowed to

carry forward losses you may have incurred in your business or investments.

(Normally this is allowed for up to 8 years and can be set off against Profits).

This could affect your Financial situation) However, Loss from House

Property is still allowed to be carried forward

2.

You are disallowed to claim a refund of any Excess Taxes you may have paid.

Sometimes due to some error, oversight, or omission, you may have paid Excess

Taxes, or a wrongful TDS may have occurred. In normal Tax Filing, you are

entitled to claim a refund and get back your rightful amount but this is

disallowed in the case of Belated Return Filing!

3.

You may not get Life Insurance

Cover.

Normally

Life Insurance Companies require you to submit your IT returns while you are

taking a Life Insurance Policy and they may well reject your policy in case of

non-submission of IT Returns

4.

Even your Credit Card company

may reduce your Credit Limit and may even cancel your Card

5.

Your Credit Standing will get hugely

affected and you may face problems while applying for loans....personal

loans...home loans...whatever!

Easy loan processing: At the time of applying for a loan, banks ask

applicants to furnish copies of tax returns for the past 2-3 years. This helps

banks understand your financial position and ability to repay the loan.

Providing a copy of returns helps in faster approval.

4.

Some countries may even deny

you a VISA if you are not able to submit your IT Returns.

FINALLY, in the worst-case scenario (your bad luck)

under sec 276cc you may notice for prosecution and get JAILED with a Rigorous Imprisonment of upto 7 years!!!!!!!!!

ANY OTHER ADVANTAGE OF FILING RETURNS??

YES.

A person should file IT returns irrespective of whether the income is within the exemption limit. Don’t we need to produce IT return statements when we apply for loans? Exemption is a privilege and we shouldn’t use it as an excuse for not filing returns.

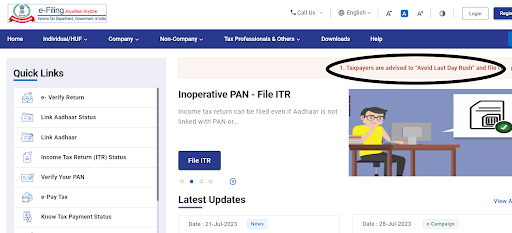

LAST MINUTE TIP :

And, despite your best efforts you still could not file your returns....then note there is still time on December 31st, 2023 to file a

Finally, you are advised to take the advice of a good qualified Chartered Accountant for all Tax Related Matters.

Best of luck,

Srikanth Matrubai

All the best,

Regards,

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/

No comments:

Post a Comment