NEXUS SELECT

TRUST REAL ESTATE INVESTMENT TRUST IPO

India's

Largest Retail Assets Owner NEXUS SELECT TRUST is coming out with an IPO. Nexus

IPO opens on 9th May with a price band of Rs.95-100 with a bid in the multiple of 150.

In India,

there are 3 REITs listed on Stock Markets namely.

Mindspace

Embassy

Brookfield

Unlike the

above 3 who manage Office spaces, Nexus is the 1st REIT that is focused on

RETAIL space.

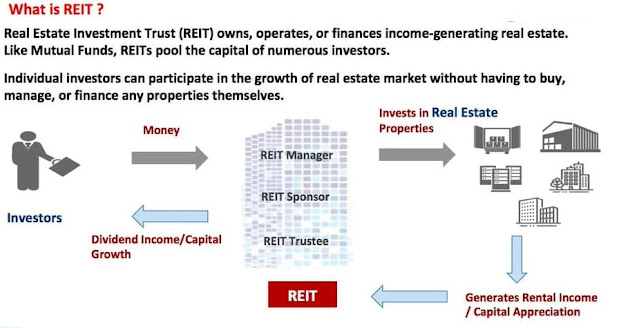

WHAT IS REIT?

REIT unlocks

the value of Real Estate Assets and offers ownership of these Rent Yielding

properties to retail investors like you and me.

Just like

Mutual Funds collect money from retail investors, pool the same and invest in

stocks, gold, bond, etc REITs too pool in the money received from investors and

invest the pooled money in REAL ESTATE ASSETS (commercial and retail)

HOW EXACTLY

DOES A REIT WORK :

1. A REIT (like a Mutual fund) collects money from

Investors.

2. These monies are invested across Rent Generating

Properties.

3. The REIT collects the Rent

4. The REIT distributes the Rent to Investors via

periodical Dividends.

5. The Capital Appreciation (of the Property owned by REIT)

is reflected in the NAV.

Regulations in India mandate that these REITs must pay out 90% of

the distributable Cash Flows to the unitholders.

ARGUMENTS IN FAVOUR OF NEXUS REITS IPO:

1. Present in 14 cities with a leasable

area of 9.2 million square feet.

2. Mix of tenants with 1044 brands with

international brands being 47% and Indian brands at 53%

3. No single tenant or asset has more

than 18.3% exposure

4. Besides consumption centres, Nexus

has 2 hotel assets and 3 Office Assets

5. Lease Expiry (weighted) is LOWER for

Retail (NEXUS) at 5.7% v/s 9 years in Office space (Embassy, Mindspace,

Brookfield)

6. Committed occupancy of 96.2%

7. Besides the Rent Escalations for

Nexus is 12% to 15% (for 3 to 5 years), a Mark to Market of 20%

8. For me, this is the

BIGGEST PRO point in favour of NEXUS.

Nexus has 88.3% of its leases with a Turnover Rental arrangement with 5% to

25% of Tenant's Sales as Rental Revenue (CLEAR UPSIDE POTENTIAL TO THE OVERALL REVENUE

OF NEXUS)

9. 100% of Nexus assets are READY FOR

RENT improving yield (unlike, for example, the Embassy which has a 16% area under

construction)

10.

Retail

asset space is expected to grow at 25% CAGR.

11.

Indian

REITS have delivered an IRR of 13.4% (since April 2019)

12.

The

offer price is at a good discount of 22% to the NAV of 127.73 (as of 31st December

2022) and can be looked at as a Debt alternative.

13.

No Lock-In. You as an Investor can enter or exit the fund

as per your wish and convenience, unlike actual Real Estate which has its

own problems thus making it very liquid.

14.

Real

Estate is one of the most non-transparent asset classes and this being a REIT

is a good transparent way to have Real

Estate Exposure.

15.

REITs,

although listed, do not always move in the same direction as the stock market

as the underlying asset is Commercial Real Estate and thus provides Good

Diversification

16.

REITs

come in between Equities and Debt and must have a place in All Portfolios. Low Correlation with Equities, Diversification

across Geographies, and Visible Cash Flow to underlying investments make REIT a

good investment option.

17.

Consumption

is expected to be a HIGH growth area in India and NEXUS being in the Retail Asset

space could be well-positioned to take maximum advantage of this expected boom

18.

ARGUMENTS AGAINST THE NEXUS REIT IPO:

1. Being in Retail, any slowdown will affect Nexus REIT badly (unlike Office REITs)

2. Interest

Rate Hikes could hurt revenues.

3. Typical

Real Estate Industry Issues like a Bear Market could affect Capital gains

4. Since the

REITs are listed in Stock Markets, the typical demand/supply mechanism could

affect the price of the listed entity and it could be quite volatile. The

returns WILL NOT BE IN 1 STRAIGHT SINGLE UPWARD LINE!

5. Real

Estate is subject to lots of Govt Regulations

IN A NUTSHELL

Owning Real

Estate is a challenge both financially and in legal hassles, REITS is an easy

simplified asset class to own the same without owning it Physically.

Investing in

REITs fund for the long term is a good way to have exposure to REAL ESTATE

Investing in

REIT is like investing in a combo of Equity and Fixed income.

REIT is an

alternative to investing in Real Estate, especially for those who cannot afford to

invest in direct real estate.

Though it

has more or less a stable return in the form of regular dividends, it also has

price volatility in stock markets too.

STANDARD

DISCLAIMER applies.

REQUEST YOU

TO PLEASE CONSULT YOUR ADVISOR BEFORE TAKING ANY DECISION ON INVESTMENT

THE DETAILS

SHARED ARE OUR OPINION ONLY AND SHOULD IN NO WAY BE TAKEN AS A RECOMMENDATION

All the Best for a Wealthy Life

Regards,

Srikanth Matrubai

Qualified Personal Finance Professional (QPFP)

AMFI Registered Mutual Fund Distributor

Author of the Amazon Best Seller books

DON'T RETIRE RICH

&

WEALTH OF WISDOM

All the best,

Regards,

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/

No comments:

Post a Comment