Taxes and Death are the only things that are

guaranteed in life.

Both cannot be avoided, and you must face them.

Thankfully, for taxes, there are some ways

where you can legally reduce your outgo and one of them is the least known but

very useful called TAX HARVESTING.

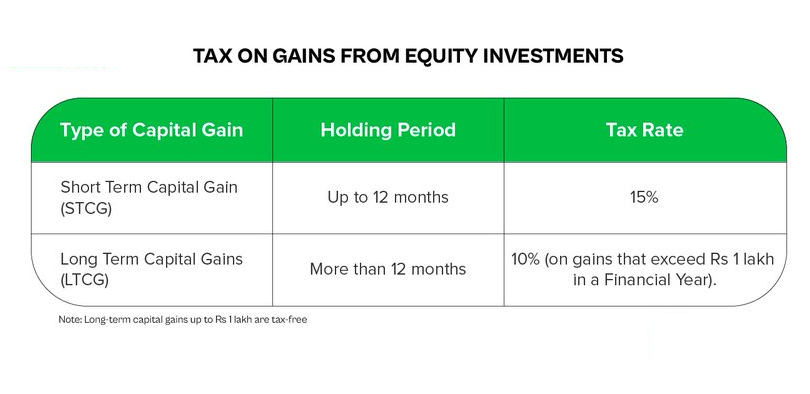

For Capital Gains, there are 2 types of taxes.

Short Term Capital Gains

Long-Term Capital Gains

Short Term Capital Gains are taxed on any

profit/gains you made in an asset/instrument within 1 year of purchase (3 years

with respect to Debt investment)

Long term Capital Gains are taxed on

profit/gains made in an asset/instrument which you are selling AFTER 1 year of

purchase

Long Term Capital Gains are taxed at 10% but

ONLY when the profit/gains exceed RS.1 lakh

But we are all here for huge profits and

not just 1 lakh, isn’t it?

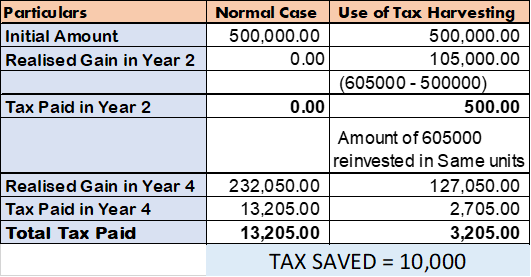

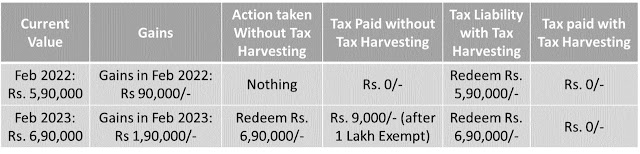

However, you can avoid the Long Term Capital Gains to some extent by using TAX

HARVESTING.

HOW DOES TAX HARVESTING WORK?

You sell your Long-Term Capital Gains asset for a profit/gain of Rs. 1 lakh and

REINVEST IMMEDIATELY.

Because your Long-term Capital Gains did

NOT cross the Rs.1 lakh limit, you DO NOT have to pay any taxes

This, of course, can be repeated year after

year.

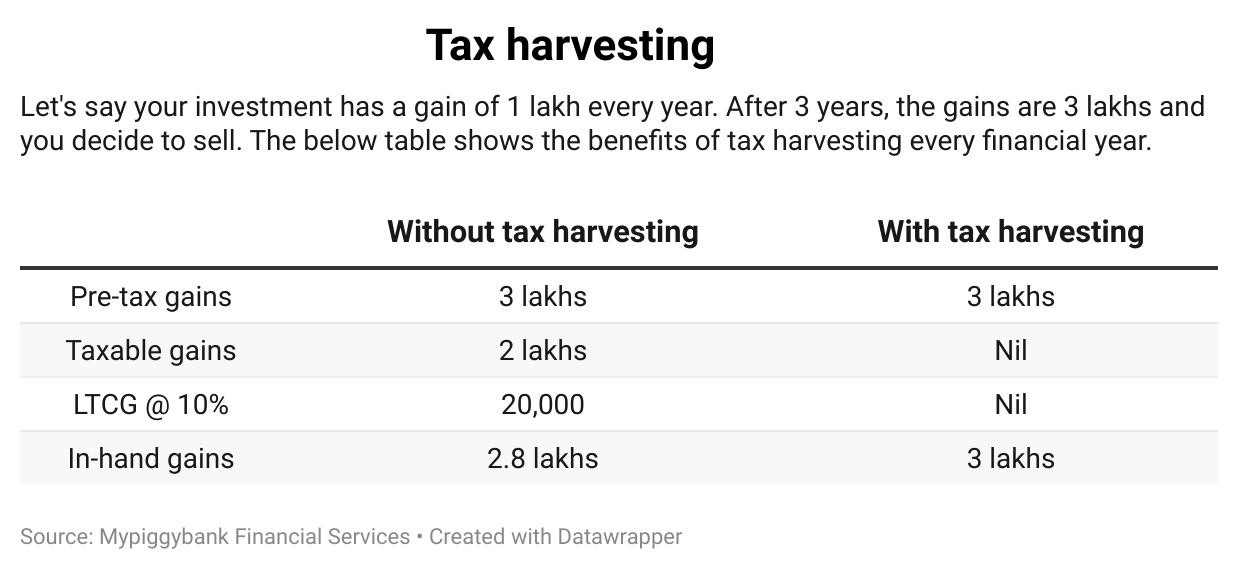

For example,

suppose you invest Rs.1 lakh in

Fund A and it becomes Rs.2 lakhs by year-end….

Sell the same and REINVEST immediately the next day. now your BUYING price (as per

Income Tax) becomes Rs.2 lakhs …

Though in reality, your actual

cost is still Rs.1 lakh.

Continuing the above example,

say in Year 2, your present Rs.2 lakhs become Rs.3 lakhs.. you again sell the

same and REINVEST immediately the next day

Your new Buying cost is Rs.3

lakhs!!!

This way, you can ensure you

are saving Long Term Capital Gains year after year (to whatever small extent)

Your Original Buying cost will remain Rs.1 lakh but as per Income Tax, it now becomes Rs.3 lakhs and when you sell for Rs.4 lakh....even though you are sitting on Rs.3 lakhs profits, instead of paying Rs.30,000 tax, you are PAYING ZERO as you have intelligently used the TAX HARVESTING!

Tax Harvesting is a strategy

that helps you minimize tax outgo and potentially help improve your investment

returns.

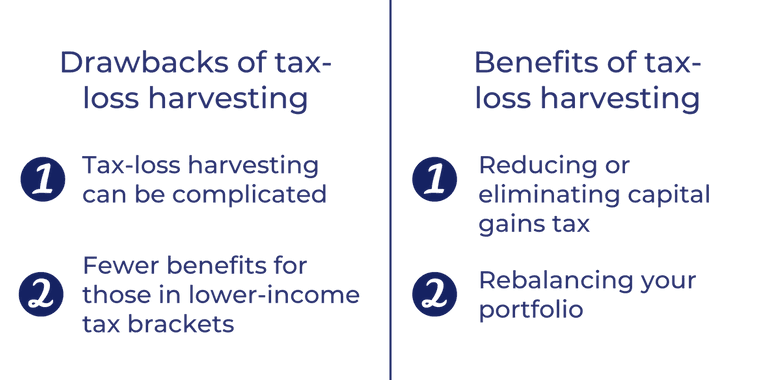

PROS AND CONS

PROS:

1. Of course, you pay LOWER taxes and save the same.

2. Higher returns as you will now have the

option of reinvesting the saved taxes

3. Tax harvesting is actually a good tool

to RE-BALANCE your portfolio too

CONS:

1. You

could end up making your REINVESTMENT price HIGHER due to fluctuations

2. Charges

like Brokerage, etc if any

3. Tracking

the actual original cost after a few years

ADDITIONAL TIP:

The best option is to invest on the same day so that you don’t miss out on the NAV

and for that, you better have some SPACE cash, especially since payouts in

equity mutual funds and equities take 2-3 days

One friend of ours… sold his shares to do

tax harvesting and planned to buy the same after 3 days but the stock SHOT UP

BY 35% IN THAT 3 DAYS !!

NOTE:

Equity Investment is for the LONG TERM and

WEALTH CREATION is the goal. Never lose

focus of this whether you do Tax Harvesting or not.

TAX HARVESTING IS TAX PLANNING and not Tax Avoidance or Tax Evasion. So, you can go about it BINDASS!!

Getting “ALPHA” besides the market returns is a challenge and TAX HARVESTING is one of the tools to get that extra ALPHA.

Its highly recommended to review your investments once a year and the end of the year would be the perfect time as you can also consider whether Tax Harvesting could fit into your strategy for you.

All the best,

Srikanth Matrubai

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/

How to take advantage of Tax harvesting ..very nicely explained.

ReplyDelete