Living a

life eagerly waiting for that SALARY DAY every month end not only leaves you with a lot of stress but also drains your entire energy, focus on TODAY rather than focusing

on planning and creating Wealth for your future life.

The BASE for

a Strong Financial Life is to have a BUDGET.

You need

to tell your money WHERE to go rather than wondering WHERE DID MY MONEY GO?

Budgeting

helps you in this. If you don't know where the paisa go, soon you'll lose the

rupees... then the house.

Remember you are the BOSS of your personal finance and since you are not answerable to anyone,

the tendency to spend WHEREVER is high.

Be

disciplined.

Budgeting is

for everyone. Poor, Middle Class, Rich... everyone. No matter how big or how

small your monthly spending is... budgeting helps you keep a track of your

spending and helps you plus the unwanted unknown spending that was happening by

you. Budgeting is driving your car with

EYES WIDE OPEN.

Good

budgeting helps you avoid Debt, plan for annual big expenses like Festivals,

School fees and even for Huge Once in Lifetime expenses like Buying a

Car, Buying a House and even planning for your Dream Retirement

1st step:

Start by

writing in detail about what your expenses are every single month. Write a plan

for the month's expenses and STICK TO the IT

Use Notes,

Excel Sheets, Mobile, or whatever helps you to maintain this. Writing this

down will help you to review your past expenses and help realise and eliminate

all those unwanted expenses

2nd Step:

Prioritise

& Eliminate

Prioritise

ruthlessly. Avoid unnecessary expenses.

Avoid

expenses that are intended to SHOW OFF.

Avoid eating

out and upgrading that smartphone unless necessary. Ruthlessly ELIMINATE unwanted expenses like

Memberships, subscriptions to TV channels that no one watches, magazines that

no one reads, etc

The access

to Credit Cards and other loans has spoilt the middle class and is preventing

them from building their wealth and becoming rich.

Avoid the

Zero EMI and Discount Sales unless you are ACTUALLY IN WANT of the

product/item.

3rd Step:

SEGREGATE

Segregate

your expenses into FIXED (Rent, Electricity Bill) and Variable (Hotel Food, Travel)

This helps

you PLAN for the Variable

Fixed

expenses are normally non-negotiable but FIXED expenses can be scaled down.

For

example:

Do you really need a 55-inch TV when a 42-inch is enough?

Do you really need an SUV car when your

family is small?

Minimise

them wherever possible as FIXED expenses have a greater impact on our Savings.

For both

Fixed and Variable expenses, a little bit of advance planning helps you save a

lot.

In fact, for

example, if you plan your family trip properly, you can get discounts on Hotel

Rates, Flight Tickets and thus save a good amount of money which can then be used

to Invest for your Retirement, etc

Even while

buying a Mobile phone, if you could buy it during festivals, there will always be

discounts and you could end up saving a few thousand rupees.

4th STEP:

Keep a

portion for unplanned emergencies.

Life doesn’t

go as per our wishes and there are always googly thrown at us.

An emergency fund helps us be prepared for home repairs and replacing non-working equipment.

Besides this

emergency fund, Health Insurance is compulsory to help us tide over medical

emergency expenses.

5th STEP:

INVEST THE

DIFFERENCE

This

budgeting is sure to help you SAVE MORE.

Now that you

have saved more, make sure that the money is INVESTED and invested as per the

Asset Allocation, Risk Horizon, and Gold Time Frame.

Take the

help of a Good Financial Expert and invest accordingly.

THE BEST WAY

TO SAVE AND INVEST IS TO AUTOMATE.

As soon as

you get the monthly income, first INVEST the planned amount and then keep the

rest of the amount for your monthly expenses.

Assume as if

the INVESTMENT is a LOAN TAKEN FOR YOUR FUTURE GOLDEN YEARS and you are paying

the EMI for it!!

6th STEP:

REVIEW AND

MAKE NECESSARY ADJUSTMENTs:

Once every 3

months, sit down again with your life partner and review your budget list to

understand if everything is on track.

This review

also helps in making adjustments wherever necessary especially if there is an

increase in monthly income (salary) and even expenses (fees, etc)

BUDGET is a

great tool in making your life a Financially successful one.

FINAL WORD:

BUDGET will

help get you.

• A Clearly Visible Sustainable Monthly

spending plans

• Practical Ways for reducing your monthly

bills

• Handling debts if any and gradually clearing

them completely.

• Help in identifying and distinguishing

your Goals be they Short Term, Medium Term, Long Term

• A Clear-Cut vision of Future Family Needs

• And of course the various sources of monthly revenue

Planning

your finances without budgeting is like eating food without salt.

Adding

little salt is not a big task, and think about the difference it brings to

your food.

Whenever in the future,

you do get a raise in monthly income, make sure that 50% of the Raise is

compulsorily diverted towards INVESTMENT.

This will

boost your Retirement Kitty and help you Retire Rich and Retire Early

Remember

that there is a huge gap between WANTING TO SAVE & ACTUAL SAVING and this

gap can be easily filled by BUDGETING.

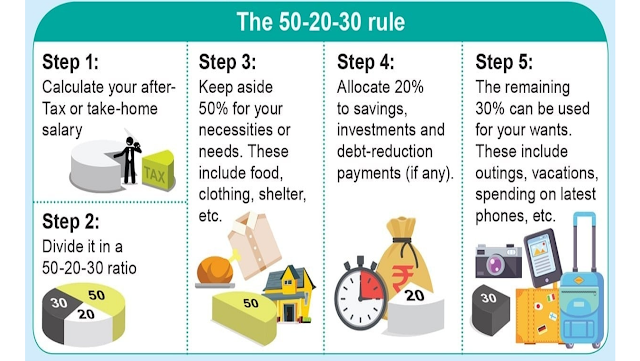

The BEST

budget according to Financial Planners is

50% Needs

30% Wants

20% Savings

Follow the

50-30-20 rule and win the Wealth World

50 percent

of the earnings after tax should be used towards necessities.

30 percent

of the money should be spent on luxuries or wants / desires.

20 percent of the money should be saved and invested towards your financial goals.

Thank you

very much for reading the article

Please make sure you follow this and elevate your Financial Life

All the best

Srikanth Matrubai

Author – Don’t

Retire Rich

Srikanth Matrubai

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/