The Slow, painful correction in Stock Markets which started

in October 2021 got magnified by a huge fall of more than 1000 points for 2 days

last week. Surprisingly there were very few (negligible) panic calls/messages

on WhatsApp university.

4-to 5 years back whenever there was a sharp correction in

stock prices, I would be flooded by phone calls / WhatsApp messages/emails

from worried investors.

The constant and consistent education about the Power of Long-Term

Investment and that Volatility is a part and parcel of all asset classes and

inevitably every investor has to face is now ingrained in the DNA of almost all

my investors

Well, almost, but not all investors.

Some new millennial investors who started only post Covid fall and have never seen a Correction in True Sense were in for a rude shock.

Obviously, the Hand-Holding and education will take time

for them to ignore these falls but I know it’s a natural reaction and very

reasonable.

Earlier the obvious question which almost all investors

would ask and now only the very new investors ask is

STOCK

MARKETS ARE FALLING EVERY DAY, WHAT TO DO NOW SIR?

“If we are

facing in the right direction, all we have to do is keep on walking,” goes

a Buddhist proverb.

So, when the Direction is right....in this case...our

Direction is Wealth Creation and our vehicle is also right...that is the Equity Mutual Funds...then there is absolutely no need to keep looking at the NAV on a

daily or even a weekly basis.

Sometimes it makes great sense to be like an Ostrich and

ignore the noise all around.

I as a concerned MFD will be like a swan weeding out bad and choosing the best ones suitable as per profile, horizon, and asset

allocation.

You, as a good investor, behave like an Ostrich and ignore

all the noise around.

CORRECTION

IS NATURAL EVEN IN BULL MARKETS

The Sensex had a BIG RALLY from 3000 levels to 21000 levels

between 2003-2007. However, the rise was not at all linear.

The Sensex fell more than 10% 13 times in this period

and out of which 1 time it was a 23% fall and another time it was a 29% fall.

Just imagine if you had WITHDRAWN your money from the

Markets when these falls happened.

You would have missed the 700% RISE for panicking after a

10% fall!

These falls of 10% - 15% are an opportunity to invest extra

savings you may have, rather than getting panicky. And, as an Accumulator

of mutual funds, you should actually be HAPPY if the NAV is coming down.

BUT WHAT

IF THIS BECOMES A REPEAT OF 2008 FALL?

A very valid question and quite understandable.

I strongly suggest you read my article on https://srikavimoney.blogspot.com/2021/09/sensex-nifty-will-never-crash-like.html

In the last 2 years, the market has moved UP by only 60%

compared to the 700% rise in the 2003-2007 Bull Run. My interaction with

Investment Experts, Wealth Professionals,, Fund Managers, and my own

experience of being in stock markets for

more than 3 decades says that the 2008 Fall will never get repeated as at that

time the Markets rally was highly abnormal.

Still, if it happens, Markets would have reached the Bubble

stage and could be easily identifiable. RELAX!!

And, of course, people talk about the 2008 fall of 52% but no

one talks about the equally sharp bounce back of 75% the following year in

2009!!!

Those who held on to their investments saw a huge jump in

their returns. Quality Portfolios gave even a bigger return.

History shows that each Big fall is followed by a Bigger jump sooner or later.

Also, read my article https://srikavimoney.blogspot.com/2021/09/sensex-nifty-will-never-crash-like.html

THE HISTORY OF BIG FALLS & THE BIGGER BOUNCEBACKS:

Year 1992 -

Sensex down by 54% in a year and up by 127% in next 1.5 yrs.

Year 1996 -

40% down in 4 years and 115% in next year

Year 2000 -

56% down in my 1.5 years and 138% up next 2.5 years.

Year 2008 -

61% down in 1 year and 157% up in next 1.5 years

Year 2010 -

28% down in 1 year and 96% up in next 3 years

Year 2015 -

22.3% down in 1 Year and 25% up in next 7 months

Year 2020 – 38%

and recovered 47% within 6 months & by 100% in 18 months!

SO, WHAT

SHOULD I DO NOW?

Stock Price Correction (and NAV falls) are but a natural phenomenon

of equity markets.

Focus on the BIGGER PICTURE...Your Goals.

When Situations Change, nobody knows how to respond.

Thankfully, being in Equities for the last 31 years has helped me understand

how to respond to this type of situation exactly as this happened many numbers

of times in my professional career.

STOPPING Your SIPs at this point of time would be nothing

short of a Disaster. It will hamper your Wealth Creation Hugely.

Firstly, understand

why you had invested in the particular fund...

Does it still

make sense to continue?

Has my Asset

Allocation altered?

Have my goals

been reasonably provided for?

Are my goals

still far off?

Always look from the angle of your GOALS.

If your goals are still far away...it still makes sense to

continue to stay invested (and in fact, add more) in Small-Cap and Mid-Caps.

History has proved time and again that Midcaps and

Small Caps have given greater returns than Large Caps.

The volatility will only increase in the NAVs from here on.

But you need to think Long Term and worry least about the

fluctuations.

These fluctuations and falls of 10% plus are actually a blessing

for long Term Wealth Creation and an

excellent time to Increase your Equity Exposure especially if your Goals and

Asset Allocation allows you to.

As your well-wisher, I would ensure that you stay the

course and get out of this Temporary Blip without you suffering a stroke and

create REAL WEALTH.

If your goals are quite far...CONTINUE to STAY INVESTED.

If your finances allow, do SIP TOP-UP and even consider

investing in a One Time Lumpsum.

As Baron Rothschild said

THE TIME TO BUY IS WHEN THE BLOOD IS RUNNING IN

THE STREETS.....EVEN IF IT IS THE BLOOD IS YOUR OWN"!!!

REMEMBER there are lots and lots of positives that are

being ignored by mainstream media, the so-called Wealth Wizards who come on TV

1. The Crude is falling

2. The Russia-Ukraine war is nearly at the ending

stage

3. The Governments are fighting the Inflation worldwide

with proactive steps making sure inflation is reined in

4. Indian Govt is spending huge on Infra which will

have a cascading effect on the entire economy

5. The Tax Collection continues to rise rapidly

indicating the strength of the Economy.

6. The fall in markets has made the PE attractive

7. The relentless selling by FII is gradually

decreasing

8. Increasing equity participation by Indian Retail

Investors

9. EPFO money that will come to the Equity Markets

henceforth month after month adding to the strength of the Indian Markets

Every economist is clear that INDIA IS THE

CLEANEST SHIRT IN THE DIRTY LAUNDRY OF THE WORLD!

TREAT EQUITY LIKE YOU TREAT LAND AND GOLD

The biggest issue with Indian Investors is that when

GOLD prices fall, and their first reaction is...

GOOD...Now I can buy more

When Land Prices fall, their reaction is ….

CHALEGA...I AM

HOLDING FOR LONG TERM

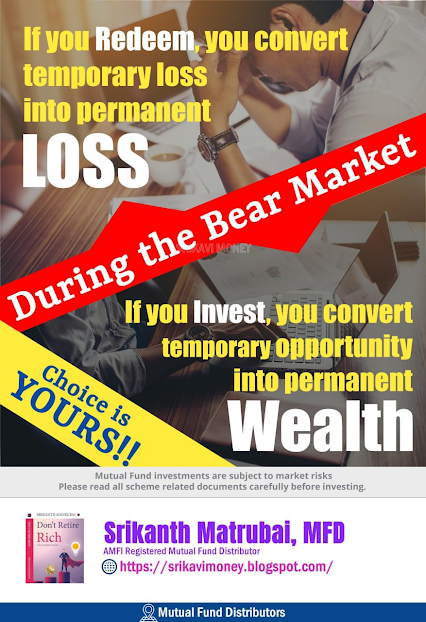

But when the same investors’ mutual fund

or equities fall, their reaction is...

IS THE END OF STOCK

MARKETS...

Has my money gone??

Let me Take out whatever is

left!!

When anyone is looking at selling off Real

Estate and the land rates have fallen by 30%, their ONLY reaction is.....”WHY SHOULD I SELL NOW?? IT'S DOWN BY 30%... I

WILL WAIT”

but, the same investor, will not even

blink when it comes to selling Equities even at a loss!!

DO NOT ALLOW YOUR NOTIONAL LOSS TO

TURN INTO PERMANENT LOSS!!

In

investing as in auto racing, you don't have to win every lap to win the race,

but YOU ABSOLUTELY DO HAVE TO FINISH THE RACE.

And when it comes to

investment and wealth creation, you should be

a) Consistent

b) Unemotional

c) Logical

d) Have no

Biases

e) Have an

expert to guide you

A Guide will instill discipline

into your investment strategy and identify the right assets for your financial

goals.

DO READ MY LATEST BOOK WOW - WEALTH OF WISDOM

Equity is not to get rich fast. It is just that equity

compounds wealth at a higher rate than other assets. Be ready to get rich

slowly.

FINALLY,

If your Direction is Right....you just need to keep on

Walking. There will be stones on the way.... you will have to

negotiate them and move on. Don’t turn away looking at the number of stones.

So, when the Direction is right....in this case...our

Direction is Wealth Creation and our vehicle is also right...that is the EQUITY

MUTUAL FUNDS...then there is absolutely no need to keep looking at the NAV on a

daily or even a weekly basis.

Regards,

Srikanth Matrubai