Do you Stale Food?

Do you eat Rotten Apples?

Do you eat Rotten Apples?

Do you let your car and other assets Rust away to Junk?

Do you let your Money Die a slow death?

Yes... The majority don't realise that they are letting their Money DIE !!

Do you let your Money Die a slow death?

Yes... The majority don't realise that they are letting their Money DIE !!

Have a huge balance in your Bank Savings Account?

Don't rejoice!

Your money is actually dying !!

Yes... Money in instruments like your Bank SB Account, Fixed Deposits, Post Office Deposits, Traditional Insurance is actually making your money DIE a slow death.

These instruments are called DYING ASSETS.

They are called DYING assets because your money is actually getting LESSER AND LESSER rather than growing.

Why?

Due to Inflation !!

A kilo of Apple, for example, which was Rs.100 last year, is now Rs.110 which means the price has gone by 10% and your income if it hasn’t grown that much will mean that you are becoming poorer and poorer slowly.

If these assets are giving you 5% returns and the Inflation is 6%, are they growing or Dying?

Of course, dying !

We need to GROW

Our assets need to GROW

and for that, we need to put our money in assets which GROW and

Growing assets are those assets that beat Inflation

and most importantly beat Taxes and Inflation both.

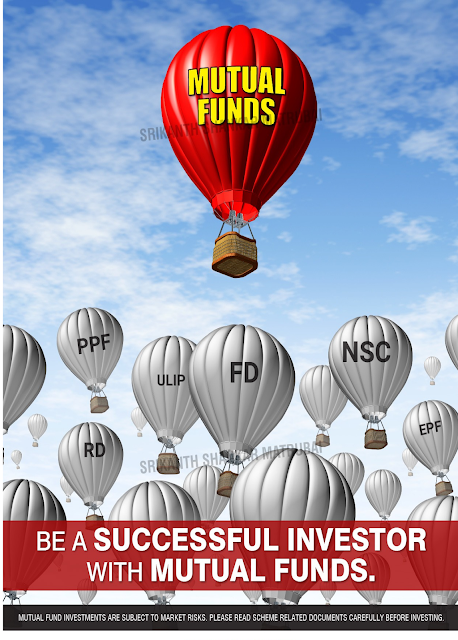

Stocks, Mutual Funds, Real Estate are those assets that have proved time and again how they beat Inflation by a handsome margin.

and especially Mutual funds have the advantage of even small investments too

Thus Mutual funds easily help us to

a) Beat Inflation by Handsome Margin

b) Route our small savings effectively

c) Achieve our Financial Goals

d) Become Financially Free

and ultimately become Financially Independent too

The villain which prevents us from becoming Rich or Wealthy is Inflation (and Taxes)

We need our money to grow faster than Inflation and Taxes so that we do not end up becoming poorer than last year.

The rich understand this better they take help of a Wealth Expert, money expert.

They understand that it's better to lose Paisa than a Rupee. They are definitely not #PaisaWiseRupeeFoolish

That's why

Rich get Richer (and further upgrade to become Wealthier)

and

Poor Remain Poor

If you don't want to remain poor....do not put your money in Dying Assets like a Bank SB, Bank Fd, etc

So, are the Dying Assets a WASTE?

No...they are not. They have got their own place in the Sun. They have got their advantages and assets.

Even here there are alternatives that you can consider

Liquid Fund > Bank SB

Debt Funds > Bank FDs

Balanced Advantage Funds > Bank Post Office Fds

Equity Mutual Funds > Traditional Insurance Plans

Even Bank SB, Bank FDs are required for specific people for specific purposes but the majority of investors just tend to PARK their money here for completely unrelated reasons letting their money Die a Slow Death.

When it comes to GROWING Your Assets,

GROWING your Wealth, you need to move away from DYING assets to WEALTH CREATION assets like the Equity Mutual funds.

So, when are you declaring your Findependence Day?

Are you in Growth Assets?

Yes? Good

Are you in the Right percentage of Growth Assets?

that's a difficult question...

Correct your percentage and upgrade yourself from Lakhpati to Drudpati

Crorepati Ka Zamana Gaya

Get in touch with your Financial Expert and make sure that your money is not Dying but Growing and Growing Happily.

Crorepati is 100 lakhs (1 Crore)

Drudpati is 10 crores (1000 Lakhs)

Drudpati is 10 crores (1000 Lakhs)

Arabpati is 100 Crores

All the best,

Regards,

Srikanth Matrubai

MUTUAL FUND DISTRIBUTOR

REBALANCE VOLATILITY CERTIFIED COACH

Srikanth Matrubai, Author of the Amazon Best Seller DON'T RETIRE RICH

Srikanth Matrubai

Author of the Amazon Best Seller DON'T RETIRE RICH

You can purchase the book on Amazon and Flipkart

For the best of ideas on where to invest to create Mountains of Wealth

join my TELEGRAM channel

WEALTH ARCHITECThttps://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/