WIN-WIN approach to Wealth under all market conditions

The SECRET OF WEALTHY Investors is that they follow

strategies and approaches which take less of their time but at the same time,

give better returns than the average portfolio and one approach which the majority

of Wealthy Investors swear by is the CORE AND SATELLITE approach to

investing.

THE CORE AND SATELLITE approach is suitable for

ALL TYPES OF INVESTORS and for all types of markets.

A poll in the Financial Times (June

2020) found that more than 2/3rd of

400 list of leading advisors have built core-satellite

portfolios for their wealthy clients.

CORE AND SATELLITE approach is one of the

simplest, effective, proven way to derive the best of both worlds of having a good

decent all-weather portfolio and also make good returns

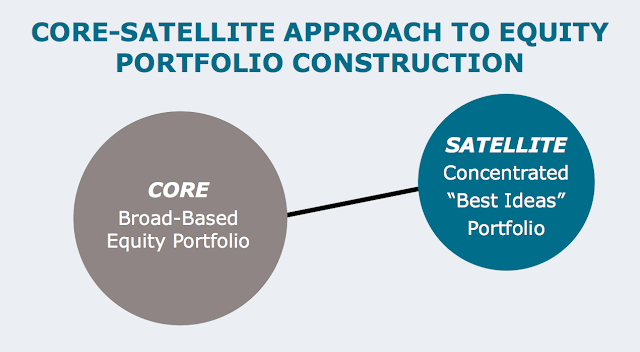

CORE & SATELLITE approach

is to SPLIT your portfolio into 2 components namely the CORE part and the SATELLITE

part.

CORE part of the portfolio focusses on

LONG TERM and focus on BUILDING A STRONG FOUNDATION and making sure that

nothing can shake the strength of your portfolio. CORE component tends

to have Large Caps, High Dividend Yield, ETFs, REITs, and even Debt exposure.

SATELLITE part of the portfolio focusses on

giving you that EXTRA kicker (the extra returns) and focuses on companies which

could become MULTI-BAGGERs and consists more of Mid-caps, Small-caps, and even

Theme/Sectors with clear-cut idea to MAXIMISE returns.

CORE is the bedrock and broader-based

and the intent is to PROTECT

SATELLITE is more company-specific (could be

theme/sector funds too) and is geared towards EXTRA returns.

CORE part of the portfolio is BORING

and seldom needs your attention. CORE tends to give returns on par with

Index and maybe just a bit slightly more

SATELLITE part of the portfolio is more geared

towards the EXCITEMENT and needs constant monitoring and the investment

requires constant regular monitoring.

Benefit of Core and satellite is

It increases the productivity ....in a sense.... you can now

FOCUS on creating that EXTRA returns via the SATELLITE component of the

portfolio as CORE component does not require that much energy and

research

Of course, cost too as only the SATELLITE is being moved

in and moved out whereas CORE will STAY as it's intended for long term

To begin with... FOCUS more towards building up the CORE part

of portfolio till you get a hang of things and only later when you have

sufficient knowledge.... you should look at SATELLITE and increase the

same.

This applies to both Mutual funds as well as Direct

Equities

The default is to have 30% in Satellite part

of the portfolio and 70% in Core part of the portfolio.

Young investors and slightly aggressive oriented investors do

tend to have 60% in Satellite and 40% in Core

The percentage of your exposure to Core and satellite depends

on various parameters like your Risk Profile, Time Horizon which an experienced

MFD/CFP would be able to do for you.

It’s generally the rule of thumb that the exposure to Satellite

component of the portfolio is to be gradually reduced as you approach your

Retirement.

Do read my book DONT RETIRE RICH and give your valuable feedback and request you to post positive comments on Amazon. https://amzn.to/3cHUM6M/

The Perfect CORE & SATELLITE portfolio brings various

benefits like

a)

Provides adequate Diversification.

b)

Stable Portfolio hugely cushioning the negative

surprises.

c)

Requires less time than a full-fledged regular

portfolio

d)

Reduces transaction cost as only the SATELLITE component is tinkered with.

e)

Tax Outgo too is reduced

f)

Beats Inflation

g) The right balance between Risk and Returns.

h)

High Potential to outperform the Markets.

Core and Satellite is like

having the BEST CRICKET TEAM full of Top-Quality Batsmen, Top quality bowlers

and an amazing combination of All Rounders who can beat any team on any pitch

on any day!

NOTE:

The SATELLITE part of the portfolio should be Complimentary

to the CORE part and should make the portfolio COMPLETE in all aspects.

The idea is to PROTECT and at the same time, INCREASE RETURNS

without compromising on the safety aspect.

To conclude the CORE & SATELLITE is an approach,

ultimately to make this approach successful, you need to have the right kind of

funds/stocks to compliment them and for that, you need to have someone who is

EXPERIENCED enough who has successfully handled investors portfolio overall

types of market cycles.

Hence, it’s a request to please contact a proven successful

experienced MFD who has been there and done that and surely you will be on the

Expressway to super Wealth Creation Road.

Please note that there is no such thing as the BEST WAY TO BUILD

A PORTFOLIO.

Having said that CORE & SATELLITE is a proven concept

and should be seriously considered for a trouble-free Wealth Creation Journey.

All the best in your Wealth Creation Journey and Please DON’T RETIRE

RICH.

FIRE AND RETIRE WEALTHY WITH WEALTHY HABITS!

Regards,

Srikanth Matrubai

SRIKAVI WEALTH

Author : DONT RETIRE RICH

You are strongly encouraged to consult your financial planner before taking any decision regarding this investment. The views expressed here is the authors personal views and should not be intrepresented as a recommendation to invest/avoid.

You can purchase the book on amazon and flipkart

Please subscribe to my TELEGRAM channel https://t.me/MutualFundWORLD/

No comments:

Post a Comment