WILL SILVER OUTPERFORM GOLD?

With the

slew of new fund launches by the Mutual Fund houses on Silver, the spotlight on

Silver has shot up.

The topic

trending on social media these days has shifted from Bitcoin and Equities to

Silver.

The SEBI has

now allowed Silver to be offered via the Mutual Fund Route.

Mutual Funds

now offer not only Equity, debt, Gold, Real Estate but also Silver.

So, now

instead of having to depend on the Physical Option of Silver, you can now consider

buying Silver via Mutual Funds with even a small monthly investment.

These Silver ETFs (Exchange Traded Funds) will be listed on Stock Markets and can be bought/sold ANYTIME and even in small quantities.

SILVER

ETFs

Silver ETFs

will invest at least 95% of their assets in silver and silver-related instruments

i.e., Exchange Traded Commodity Derivatives (ETCDs) that have silver as the underlying asset. Accordingly, Silver ETFs will have a dedicated fund manager

having relevant skills and experience in the commodity market including the commodity derivative market.

Silver ETFs

will have to own physical silver of standard 30 Kg bags with 99.9% purity

confirming to LBMA Good Delivery Standards. The exposure to silver ETCDs should

not exceed 10% of the net asset value (NAV) of the scheme. However, the 10%

limit will not apply to Silver ETFs if they intend to take delivery of the

physical silver instead of rolling over its position to the next contract cycle.

WHAT IS THE OUTLOOK FOR SILVER?

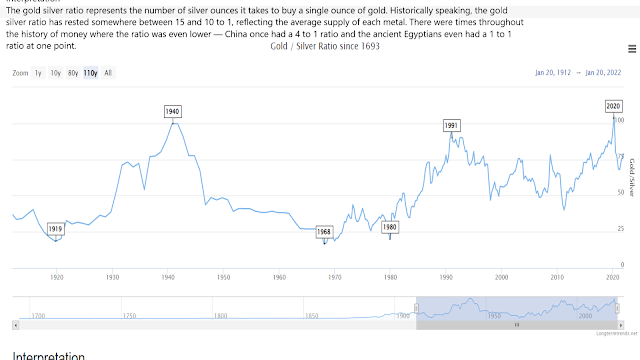

Traditionally, Silver has been a poor cousin of Gold moving in tandem or slightly lesser than Gold but the past 15 months it’s been a completely different story.

Yes....the way demand for Silver is shaping up....it wouldn’t be a surprise to see Silver demand only going up more and more than Gold in the days ahead Investment in Silver is done for the same type of reasons as for Gold.

Precious

Metal, Rare, Safe Haven, Hedge against Inflation amongst others, albeit at a

lesser.

The steadily increasing usage of silver vis a vis Gold which is purely used for Hedging purposes points to a bullish outlook for Silver.

The Gold-Silver Ratio too supports the point that Silver prices could see a spike

NEW

USAGE OF SILVER:

Silver is

largely consumed for Industrial purposes. 50% of Silver Demand is for

Industrial Production (btw, for Gold, the usage is very limited at around 10%).

Silver is

largely used in the Electrical and Automobile Industries.

Silver usage

which was ZERO earlier in many places are being used in plenty especially where

high-pressure heat generation is required, be it Semi-Conductors, Printed

Circuit Boards, Wireless communication, aerospace, automotive, etc

In fact,

Silver is used more in Industry than for decorative purposes.

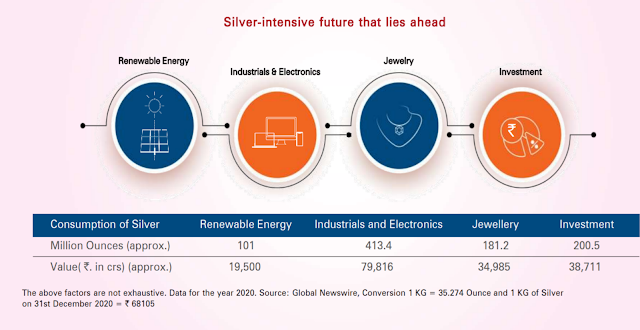

Going ahead,

Silver is widely touted to be used in Electric Vehicles, Solar Panels, and 5G

Towers.

Silver usage is increasing due to its usefulness in making our Planet Greener and Cleaner.

Digital technology is creating unprecedented demand for silver which cannot be recycled, almost all digital

Technology products use silver as one of the main components.

The

Silver Institute estimates that silver demand from the automotive industry will

reach 88 million ounces by the middle of this decade (up from just over 60

million ounces in 2021). In 2040, electric vehicles could even devour almost

half of the annual silver supply (currently, a good 1 billion ounces). Yes... 50% of all Silver Supply could well be gobbled up by Electic Vehicles.

All these

are poised for EXPONENTIAL GROWTH and obviously, the biggest beneficiary will be

Silver.

In fact, it

may not be a surprise if Silver outperforms Gold by a good margin in the coming

years.

DEMAND

SUPPLY SCENE FOR SILVER:

Silver

Demand has been increasing quite sharply since 2019 resulting in more demand

than supply.

While supply

is rising by 8% year on year, the demand has been rising at 15% making a case

for Bullishness in Silver.

With

increased demand was seen from Solar Energy Sector, Silver being a great conductor

of both heat and electricity, the demand for Silver will only increase.

The Global economic

scenario is improving which will only add to the demand for Silver.

Silver supply not matching the surging Silver Demand is a definite possibility.

Silver,

historically, has been MORE volatile than Gold.

Silver and

Gold tend to do well when Equity Markets are in the bear phase and thus make a

strong case for Asset Allocation.

One more

POSITIVE for Silver is that, unlike Gold, Silver does not have to face the sword

of the threat of selling by Central Banks. World over, all Central banks hoard Gold

in huge quantities and often sell tons of Gold to tide over distress times

which sharply affects Gold Prices.

The ratio of silver recycling is far too less compared to Gold:

BEST

WAY TO SILVER INVESTMENT:

Paper form of investment in Silver is a great form of exposure to Silver not only due to purity factor, taxation, liquidity.

Silver ETFs

will be one of the preferred ways for investors to take exposure to silver as

one need not worry about the bulky nature of silver, purity, quality, or

liquidity of the investment. Silver is among the preferred options globally

when it comes to investing in precious metals. This is because silver is

considered as a store of value, hedge against inflation and has a very limited

correlation with other asset classes

Obviously, the

best way to get exposure to Silver will be the PAPER form.

Silver is

very bulky in nature and there is always a question mark on the purity of

physical silver followed by the safety of keeping it and then the liquidity of

disposing silver.

All these is

taken care of by 1 single form of investment...that’s the PAPER form and hence the

Fund of Funds will be a good way to get exposure to Silver

ETF or

FUND OF FUNDS:

Many AMCs

have now launched Silver ETFs

Silver ETF

is a passively managed exchange-traded fund that will employ an investment

approach designed to track the performance of the Domestic Price of Silver as

derived from the LBMA (London Bullion Market Association) AM fixing prices. As

per the SEBI rules, all Silver ETFs must hold silver having 99.9% purity.

While both

have their pros and cons, the Fund of Fund route outshines.

1. In

ETF, you need to mandatorily have a DEMAT account

2. In

ETF, you will be paying BROKERAGE both while buying and selling

3. In ETF

the rates can be volatile and depends on the market movement and demand/supply

scenario

In Fund

of Funds, no need for Demat account

In Fund

of Funds, I don’t pay an entry load nor an exit load

In Fund

of funds, the AMC will pay/issue units and no worry or liquidity and no case of

Demand/supply scene here

We have

observed over the years how Gold ETFs have suffered liquidity issues on stock

markets and hence the Fund of Fund route is a better way to take Silver Exposure.

Taxation

Of Silver ETFs

Gains from Silver ETFs will be treated as short-term if you sell them within three years of purchase. Short-term gains will be added to your income and will be taxed at your income tax slab rate. After 3 years, gains from Silver ETF will be treated as long-term and will be taxed at 20% plus indexation. Thus, since the indexation benefit is there…your net tax could well be in a single digit.

Silver has

always been looked at as a tactical allocation, but the way things are shaping

up.... maybe it’s time to have a strategic allocation towards Silver.

Silver as an

asset class is an investment that makes for a good case for hedging against

inflation and with its rising demand, we could well see the days of SILVER

outpacing Gold in demand and price rise.

It's a fact that Gold has no PRACTICAL usage and is mainly for decorative purposes whereas

Silver has many practical usages and the usage of Silver is only spreading further, wider and deeper.

People who

now say

GOLDEN

CHANCE/ GOLDEN OPPORTUNITY

may well

change to

SILVERY

CHANCE / SILVERY OPPORTUNITY!!

Silver is

very volatile and hence makes sense to look at silver investment via the SIP /

STP mode and also be sure to have the right entry/exit points

It would be

prudent to take your Investment Solutions Provider’s guidance as

they would be in a better position to guide you appropriately.

I would only

say….

You may not have been born with SILVER SPOON, but you could live and enjoy the

rest of your life with a SILVER SPOON with the right kind of investment based on your

risk profile and asset allocation.

And who knows, in the future instead of saying

Silver is poor man's Gold

they may well say

Gold is poor man's Silver

Disclaimer: the above statement is definitely an exaggeration

However, my view on Silver is that it could make a better investment than Gold at least for the next couple of years

(These are my personal views. You are strongly advised to take the guidance of an expert and then take appropriate investment decisions. We will not be held responsible as this blog is purely personal in nature and is generic in nature and shared purely for educational purposes)

All the

best,

Srikanth

Matrubai

Srikanth Matrubai Author of the Amazon Best Seller DON'T RETIRE RICH

https://t.me/joinchat/AAAAAELl4KUnaJzi-JJlDg/